(all amounts in US dollars, unless otherwise noted)

Vancouver, British Columbia – Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the "Company") is pleased to announce its 2021 production results, 2022 guidance and a five-year operating outlook through 2026.

HIGHLIGHTS

Record Copper Production Result for 2021

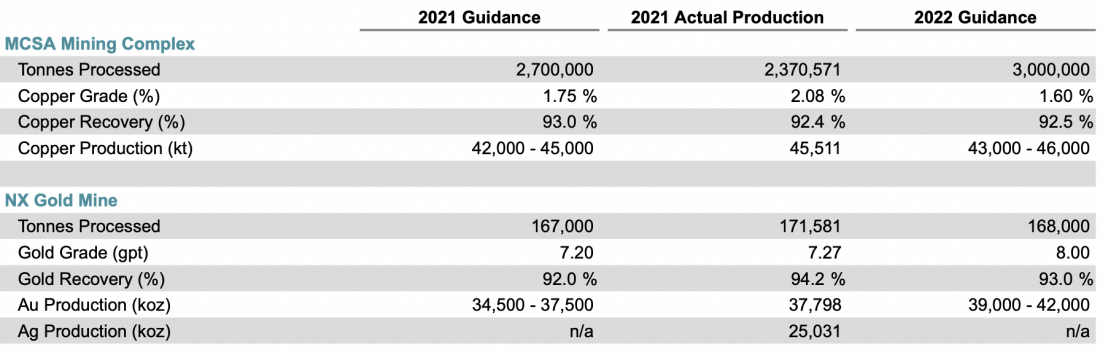

- At the MCSA Mining Complex, total production for 2021 was 45,511 tonnes of copper in concentrate, surpassing the high-end of full-year guidance of 42,000 to 45,000 tonnes; and,

- At the NX Gold Mine, total production for 2021 was 37,798 ounces of gold, surpassing high-end of full-year guidance of 34,500 to 37,500 ounces of gold.

Updated mineral reserve estimate for Deepening Extension Zone enables the creation of a two- mine system at the Pilar Mine with redesigned larger external shaft

- The creation of a two-mine system at the Pilar Mine, known as "Pilar 3.0", whereby the upper levels of the mine will be serviced by the existing shaft, while the Deepening Extension Zone will utilize the new, larger external shaft, expected to result in significant growth in total production from the mine;

- Annual ore production from the Pilar Mine is now forecast to achieve approximately 3.0 million tonnes by 2026 versus the current production rate of approximately 1.3 million tonnes. From 2027 onwards, annual ore production is expected to range from 2.6 million to 3.0 million tonnes; and,

- Pilar 3.0 results in the deferral of capital related to the construction of higher operating cost ore- sorting projects at N8/N9 and Siriema.

2022 Production, Cost and Capital Expenditure Guidance

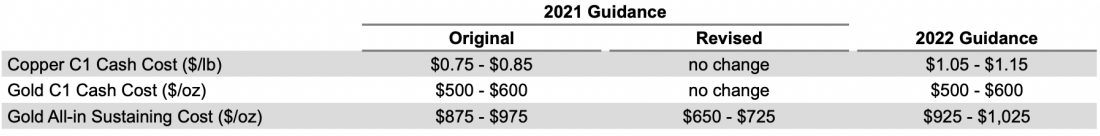

- 2022 MCSA Mining Complex production guidance of 43,000 to 46,000 tonnes of copper in concentrate at a C1 cash cost guidance range of $1.05 to $1.15 per pound of copper produced;

- 2022 NX Gold Mine production guidance of 39,000 to 42,000 ounces of gold at C1 cash cost and all-in sustaining ("AISC") guidance ranges of $500 to $600 and $925 to $1,025 per ounce of gold produced, respectively; and,

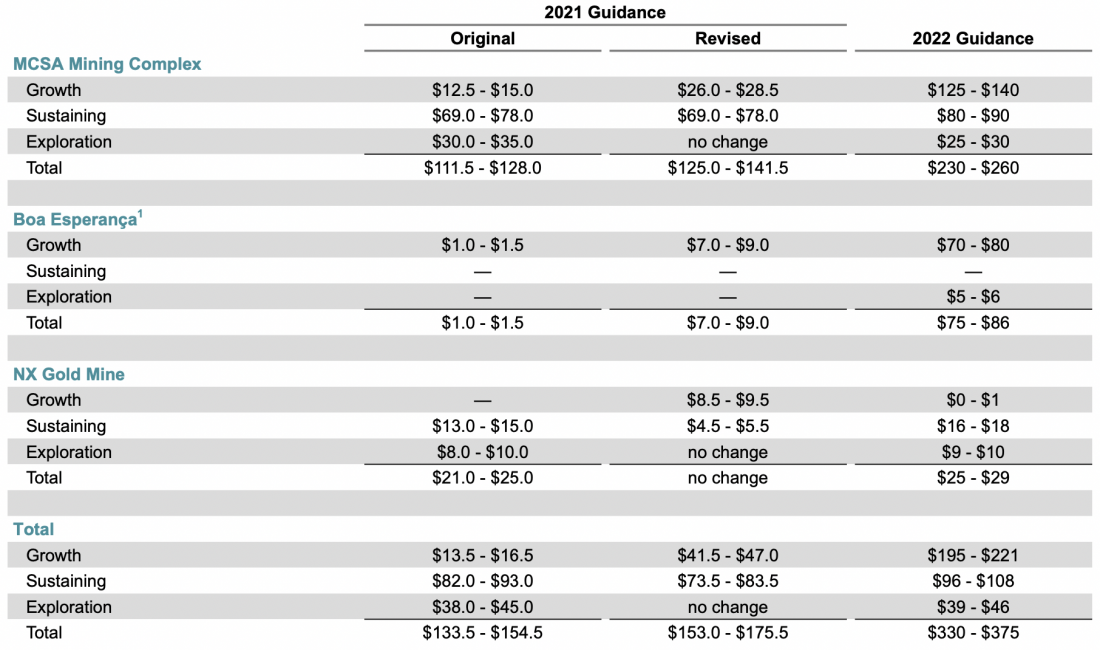

- Capital expenditures expected to total $330 to $375 million in 2022, including $39 to $46 million in consolidated exploration spend and $70 to $80 million towards the construction of the Boa Esperança Project expected to commence in Q2 2022, subject to approval by the Board of Directors of the Company. Also reflected in the 2022 capital expenditure guidance:

- Ongoing construction of the larger external shaft and completion of the Phase 2 cooling project as part of Pilar Mine 3.0; and,

- Commencement of the Caraíba Mill expansion to 4.2 million tonnes per annum in preparation for expanded operations at the MCSA Mining Complex.

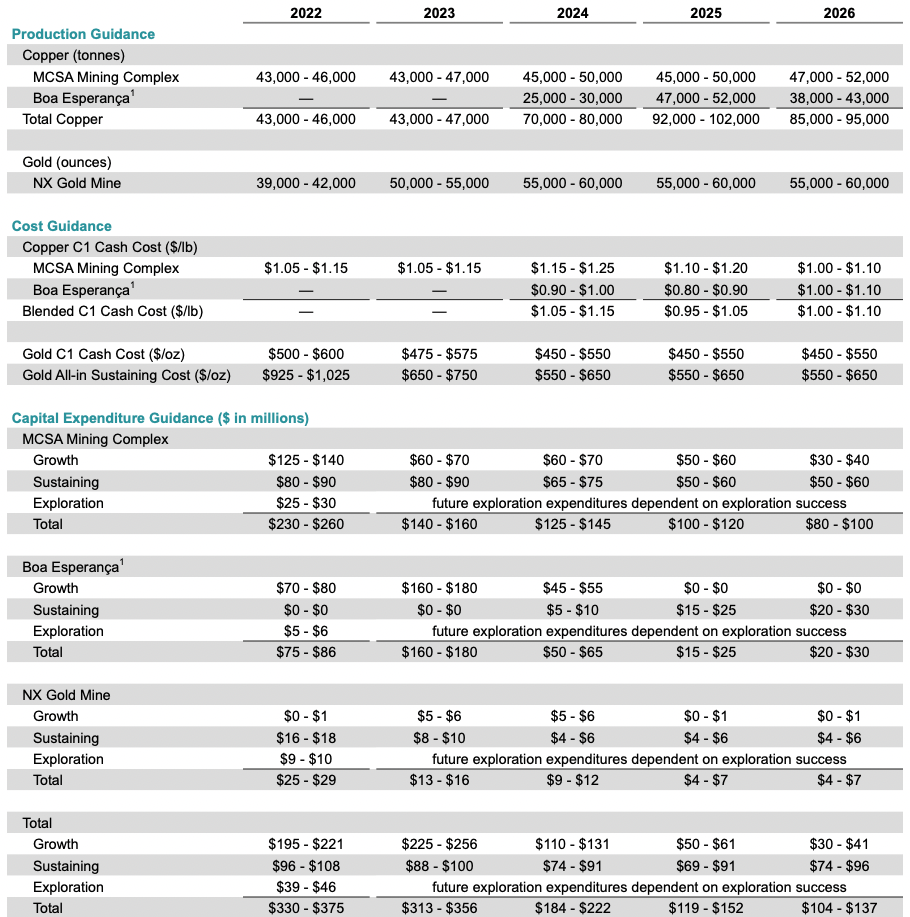

5-Year Operating Outlook

- Copper production is forecast to more than double1 compared to the Company's 2021 results to a range of 92,000 to 102,000 tonnes of copper in concentrate in 2025, assuming contributions from the Boa Esperança Mine2;

- Copper C1 cash costs are expected to average approximately $1.051 per pound of copper produced on forecasted production totaling approximately 350,0001 tonnes from 2022 to 2026;

- Annual gold production is forecast to increase to a range of 55,000 to 60,000 ounces by 2024, an increase of over 50%1 compared to 2021 results;

- Gold C1 cash costs and AISC are expected to average approximately $5151 and $6751, respectively, per ounce of gold produced with production totaling approximately 265,0001 ounces from 2022 through 2026; and,

- Key capital projects aimed at doubling copper production, positioning the MCSA Mining Complex for expanded operations, and achieving higher sustained gold production at the NX Gold Mine include:

- Approximately $300 million for the construction of the Boa Esperança Project2;

- Approximately $250 million for the construction of Pilar 3.0 including the larger external shaft, associated infrastructure, ventilation, cooling and equipment plus an estimated $35 million for ancillary capital costs including contingency and third-party construction management costs;

- Approximately $30 million to support expanded operations at the MCSA Mining Complex, including the expansion of mill capacity for the Caraíba Mill to 4.2 million tonnes per annum and long-term tailings storage capacity improvements to support the increased throughput and longer mine life; and,

- Approximately $10 million to support higher sustained gold production of approximately 60,000 ounces at the NX Gold Mine as part of the Company's "NX 60" initiative

- Based on midpoint of guidance range(s).

- Outlook assumes contributions from the Boa Esperança Mine. Construction of the Boa Esperança Project is expected to commence in Q2 2022 but remains subject to the approval of the Board of Directors of the Company.

Commenting on the results, David Strang, CEO, stated, "2021 was a pivotal year for Ero Copper. Our team delivered another year of record production results and laid the foundation for significant organic growth of copper and gold production in the years ahead. In addition to announcing the results of our optimized Feasibility Study on the Boa Esperança Project and demonstrating meaningful growth in our reserves and resources across our operating portfolio, we completed a redesign of the Pilar Mine, known as Pilar 3.0. Both projects fit with our focus on maximizing returns on invested capital ("ROIC"). In the case of Pilar 3.0, we have replaced a lower ROIC initiative, the ore sorting project, with a higher one. Likewise, at our NX Gold operations, we have initiated a project, known as NX 60, that is focused on sustaining longer term gold production of approximately 60,000 ounces per year by incorporating the new Matinha Vein into our mine plan from 2024 onwards.

"We are now well-placed to achieve the next stage of our growth — becoming a 100,000 tonne a year copper and 60,000 ounce a year gold producer by 2025 — while maintaining first quartile operating costs and industry-leading ROIC."

2021 PRODUCTION RESULTS

- At the MCSA Mining Complex, approximately 2.4 million tonnes of ore grading 2.08% copper was processed during the year, resulting in 45,511 tonnes of copper in concentrate produced after average metallurgical recoveries of 92.4%;

- Fourth quarter mill throughput of 646,319 tonnes of ore grading 1.99% copper resulted in 11,918 tonnes of copper in concentrate produced after average metallurgical recoveries of 92.7% during the period;

- At the NX Gold Mine, 171,581 tonnes of ore grading 7.27 grams per tonne ("gpt") gold was processed during the year, producing 37,798 ounces of gold and 25,031 ounces of silver as by-product after average metallurgical recoveries of 94.2%;

- Fourth quarter mill throughput of 47,159 tonnes of ore grading 6.24 gpt gold resulted in 8,544 ounces of gold produced and 5,859 ounces of silver produced as by-product after average metallurgical recoveries of 90.3% during the period;

2022 PRODUCTION GUIDANCE

Copper production guidance from the MCSA Mining Complex in 2022 of 43,000 to 46,000 tonnes of copper in concentrate is expected to come from the Pilar and Vermelhos underground mines as well the Surubim open pit mine. Total ore processed of approximately 3.0 million tonnes at a blended grade of 1.60% copper is expected to be comprised of 1.8 million tonnes at 1.50% copper from the Pilar Mine, 900,000 tonnes at 2.05% copper from the Vermelhos Mine, and 300,000 tonnes at 0.75% copper from the Surubim Mine.

Gold production guidance from the NX Gold Mine for 2022 of 39,000 to 42,000 ounces is expected to come from the Santo Antônio Vein based on total ore processed of approximately 168,000 tonnes at a gold grade of 8.00 grams per tonne.

Note: Guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical performance. Please refer to the Company's SEDAR and EDGAR filings, including the Company's Annual Information Form for the year ended December 31, 2020 and dated March 16, 2021 (the "AIF") for complete risk factors.

Note: C1 Cash Costs and AISC are non-IFRS measures. Please see the Notes section of this press release for additional information. 2021 guidance assumed a USD:BRL exchange rate of 5.00, with no change to gold and silver price assumptions.

2022 COST GUIDANCE

C1 Cash Cost guidance at the MCSA Mining Complex in 2022 of $1.05 to $1.15 per pound of copper produced reflects increased mill feed from the Surubim open pit mine compared to its partial year of production in 2021. AISC per ounce of gold produced at the NX Gold Mine in 2022 reflect higher sustaining capital expenditures related to projects rescheduled from 2021 to 2022. The Company's 2022 cost guidance assumes a USD:BRL foreign exchange rate of 5.30, a gold price of $1,725 per ounce, and a silver price of $20.00 per ounce.

Note: C1 Cash Costs and AISC are non-IFRS measures. Please see the Notes section of this press release for additional information. 2021 guidance assumed a USD:BRL exchange rate of 5.00, with no change to gold and silver price assumptions.

2022 CAPITAL EXPENDITURE GUIDANCE

Forecasted capital expenditures for 2022 reflect growth investments related to expanding production at the MCSA Mining Complex (Pilar 3.0), development of the Matinha Vein (part of project NX 60), and the planned construction of the Boa Esperança Project1. Higher expected sustaining capital expenditures at the NX Gold Mine are related to the timing of certain sustaining capital projects that were deferred from 2021 into 2022. The Company's capital expenditure guidance for 2022 assumes a USD:BRL foreign exchange rate of 5.30 versus a 5.00 USD:BRL foreign exchange rate assumed in 2021. Capital expenditure guidance has been presented below in USD millions.

- Capital expenditures for the construction of the Boa Esperança Project expected to commence in Q2 2022, subject to receipt of approval by the Board of Directors of the Company. For more information on the Boa Esperança Project, including capital expenditure assumptions, please refer to the NI 43-101 compliant technical report entitled "Boa Esperança Project NI 43-101 Technical Report on Feasibility Study Update" dated November 12, 2021 with an effective date of August 31, 2021, prepared by Kevin Murray, P. Eng., Erin L. Patterson, P. Eng., and Scott C. Elfen, P.E., all of Ausenco Engineering Canada Inc., Carlos Guzmán, FAusIMM RM CMC of NCL Ingeniería y Construcción SpA, who are independent qualified persons under NI 43-101, and Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission) and Resource Manager of the Company (the "2021 Boa Esperança Technical Report").

5-YEAR OPERATING OUTLOOK

The Company's five-year operating outlook reflects execution of the following strategic growth projects:

- Construction of and production ramp-up at the Boa Esperança mine with construction to commence in Q2 2022, subject to receipt of approval by the Board of Directors of the Company;

- Pilar 3.0 beginning with construction of the new external shaft and associated development at the Deepening Extension Zone followed by ramp-up of production volumes to 3.0 million tonnes in 2026, with longer-term (2027 onwards) volumes forecast to be between 2.6 and 3.0 million tonnes;

- Investments to support expanded operations at the MCSA Mining Complex, including increasing both processing capacity of the Caraíba Mill to 4.2 million tonnes per annum and long-term tailings storage capacity to support the extended mine life; and,

- The development of the Matinha Vein at the NX Gold Mine in support of project NX 60, with production from this new vein expected to commence in 2024.

The Company's 2022 cost and capital expenditure guidance assumes a USD:BRL foreign exchange rate of 5.30, while all subsequent years assume a USD:BRL foreign exchange rate of 5.00. Cost guidance assumes a gold price of $1,725 per ounce and a silver price of $20.00 per ounce for the five-year projection period. Capital expenditure guidance has been presented in the following table in USD millions.

Note: Guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical performance. Please refer to the Company's SEDAR and EDGAR filings, including the AIF, for complete risk factors. C1 Cash Costs and AISC are non-IFRS measures. Please see the Notes section of this press release for additional information. For more information on the Boa Esperança Project, including production, cost and capital expenditure assumptions, please refer to the 2021 Boa Esperança Technical Report.

- Outlook assumes contributions from the Boa Esperança Mine. Construction of the Boa Esperança Project is expected to commence in Q2 2022 but remains subject to the approval of the Board of Directors of the Company.

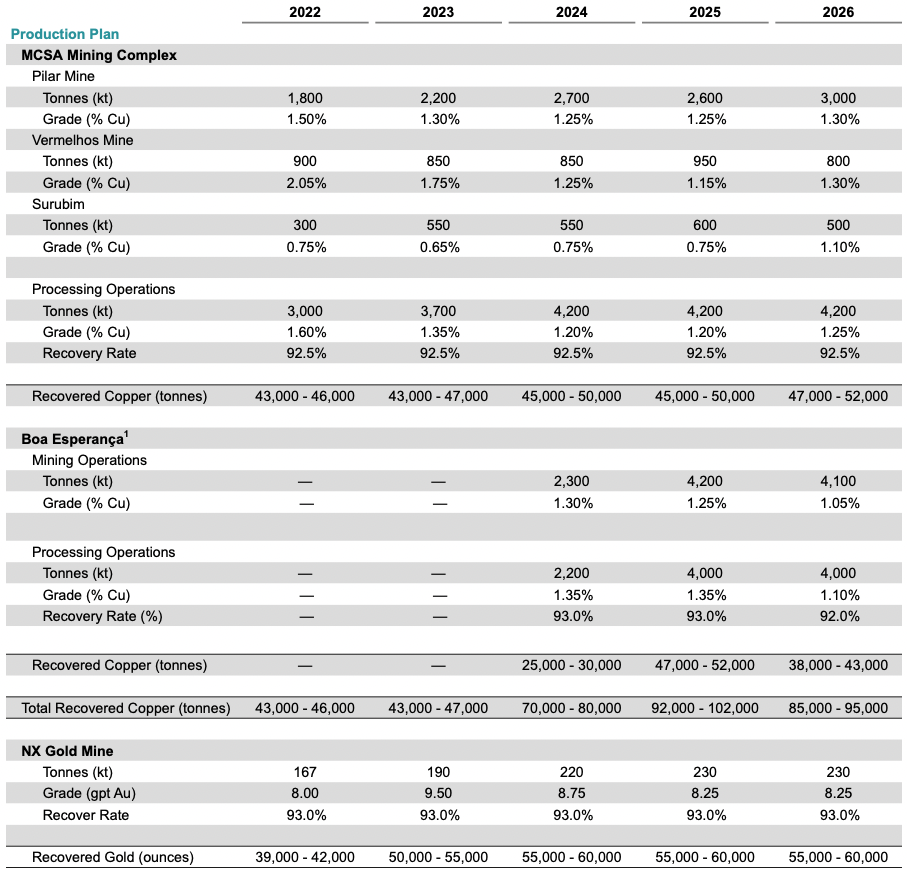

5-YEAR PRODUCTION PLAN

The Company's five-year operating outlook reflects the five-year production plan estimates provided below. Tonnes and grades are based on current mine plan assumptions and represent the midpoint of performance expectations with a range of +/- 10%.

Note: Guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical performance. Please refer to the Company's SEDAR and EDGAR filings, including the AIF, for complete risk factors. For more information on the Boa Esperança Project, including production assumptions, please refer to the 2021 Boa Esperança Technical Report.

- Outlook assumes contributions from the Boa Esperança Mine. Construction of the Boa Esperança Project is expected to commence in Q2 2022 but remains subject to the approval of the Board of Directors of the Company.

NOTES

Non-IFRS measures

Financial results of the Company are prepared in accordance with IFRS. The Company utilizes certain non-IFRS measures, including C1 cash cost of copper produced (per lb), C1 cash cost of gold produced (per ounce), AISC of gold produced (per ounce), EBITDA, Adjusted EBITDA, Adjusted net income attributable to owners of the Company, Adjusted net income per share, net debt, working capital and available liquidity, which are not measures recognized under IFRS. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

C1 cash cost of copper produced (per lb.)

C1 cash cost of copper produced (per lb) is the sum of production costs, net of capital expenditure development costs and by-product credits, divided by the copper pounds produced. C1 cash cost reported by the Company include treatment, refining charges, offsite costs, and certain tax credits relating to sales invoiced to the Company's Brazilian customer on sales. By-product credits are calculated based on actual precious metal sales (net of treatment costs) during the period divided by the total pounds of copper produced during the period. C1 cash cost of copper produced per pound is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company's operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

C1 cash cost of gold produced (per ounce)

C1 cash cost of gold produced (per ounce) is the sum of production costs, net of capital expenditure development costs and silver by-product credits, divided by the gold ounces produced. By-product credits are calculated based on actual precious metal sales during the period divided by the total ounces of gold produced during the period. C1 cash cost of gold produced per ounce is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company's operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

All-in Sustaining Cost of gold produced (per ounce)

All-in sustaining cost of gold produced (per ounce) is the sum of production costs, site general and administrative costs, accretion of mine closure and rehabilitation provision, sustaining capital expenditures, sustaining leases, and royalties and production taxes, net of silver by-product credits, divided by the gold ounces produced. By-product credits are calculated based on actual precious metal sales during the period divided by the total ounces of gold produced during the period. All-in sustaining cost of gold produced per ounce is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company's operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

QUALIFIED PERSONS

The technical and scientific information in this news release has been prepared in accordance with NI 43-101 and has been reviewed, verified and approved by Mr. Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission) and Resource Manager of the Company, who is a Qualified Person as such term is defined under NI 43-101.

ABOUT ERO COPPER CORP

Ero Copper Corp, headquartered in Vancouver, B.C., is focused on copper production growth from the MCSA Mining Complex located in Bahia State, Brazil, with over 40 years of operating history in the region. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the MCSA Mining Complex, which is comprised of operations located in the Curaçá Valley, Bahia State, Brazil, wherein the Company currently mines copper ore from the Pilar and Vermelhos underground mines, and the Boa Esperança development project, an IOCG-type copper project located in Pará, Brazil. The Company also owns 97.6% of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the MCSA Mining Complex, Boa Esperança and NX Gold properties, can be found on the Company's website (www.erocopper.com), on SEDAR (www.sedar.com), and on EDGAR (www.sec.gov).

ERO COPPER CORP.

/s/ David Strang

David Strang, CEO

For further information contact:

Courtney Lynn, VP, Corporate Development & Investor Relations

(604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). Forward-looking statements include statements that use forward-looking terminology such as "may", "could", "would", "will", "should", "intend", "target", "plan", "expect", "budget", "estimate", "forecast", "schedule", "anticipate", "believe", "continue", "potential", "view" or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking statements include, without limitation, statements with respect to mineral reserve and mineral resource estimates; targeting additional mineral resources and expansion of deposits; the Company's expectations, strategies and plans for the MCSA Mining Complex and the NX Gold Property, including, but not limited to, the Company's planned exploration, development and production activities; the significance and timing of any particular exploration program or result and the Company's expectations for current and future exploration plans including, but not limited to, planned areas of additional exploration, the significance of any new discoveries and targets including, but not limited to, extensions of defined mineralized zones, possibilities for mine life extensions or continuity of high-grade mineralization, and the timing and advancement of ongoing projects including the Deepening Extension Project.

Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management's experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this press release including, without limitation, assumptions about: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company's properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the MCSA Mining Complex, NX Gold Property and the Boa Esperança Property being as described in the technical reports for these properties; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force conditions to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment and critical supplies, spare parts and consumables; positive relations with local groups and the Company's ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company's current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive, global health, and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking statements involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation the risk factors listed under the heading "Risk Factors" in the Annual Information Form for the year ended December 31, 2020 and dated March 16, 2021.

Although the Company has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained herein. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the "SEC") generally applicable to U.S. companies. For example, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in NI 43-101. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with measured or indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.