Vancouver, British Columbia – Ero Copper Corp. (the “Company”) (TSX: ERO) is pleased to provide a quarterly update on the ongoing exploration drill programs on its 99.6% owned Vale do Curaçá Property located in Bahia State, Brazil and its 97.6% owned NX Gold Mine located in Mato Grosso State, Brazil. This update encompasses drill results received from March 2020 through early June 2020. Drilling during the period continued to focus on priority target areas within the Pilar and Vermelhos Mines, the broader Curaçá Valley, as well as extensions of the Santo Antonio Vein at the NX Gold Mine, all according to the drill program for the second quarter of 2020, which continues to progress according to budget despite the COVID-19 pandemic.

HIGHLIGHTS

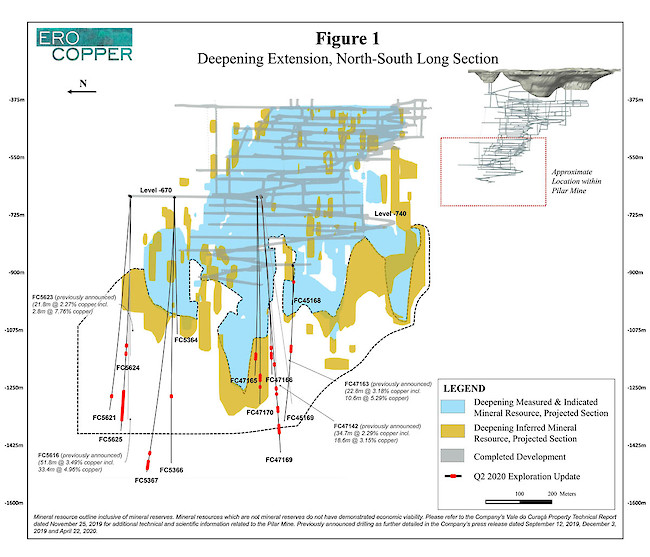

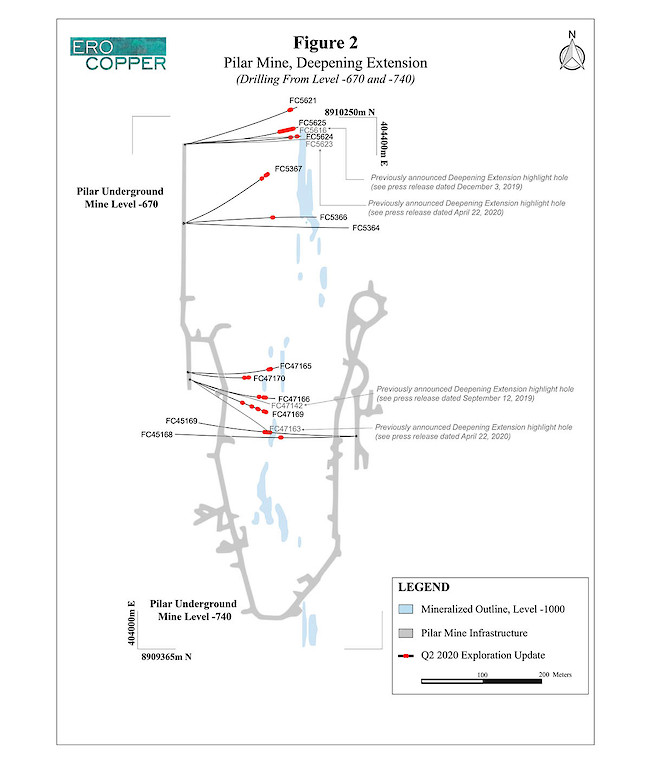

- Continued success in demonstrating high-grade continuity and wide-open potential at depth within the Company’s ‘Superpod’ discovery below the known extent of the Pilar Mine, part of the “Deepening Extension” zone. Results are highlighted by:

- FC5625: 96.4 meters grading 3.97% copper including 60.6 meters grading 5.61% copper, the highest grade-meter intercept drilled by the Company at the Vale do Curaçá Property to date;

- FC5367: 29.9 meters grading 5.90% copper, the deepest intercept drilled by the Company in the Pilar mine to-date, approximately 100 meters below the Company’s previously announced deepest intercept;

- FC47165: 19.6 meters grading 3.61% copper including 10.0 meters grading 5.09% copper, drilled approximately 265 meters and 400 meters south of hole FC5367 and FC5625, respectively; and,

- mineralized intercepts within the Deepening Extension continue to demonstrate continuity over approximately 800 meters in strike length and to depth over 500 meters below the current level of the primary ramp. The zone remains open to the north and to depth.

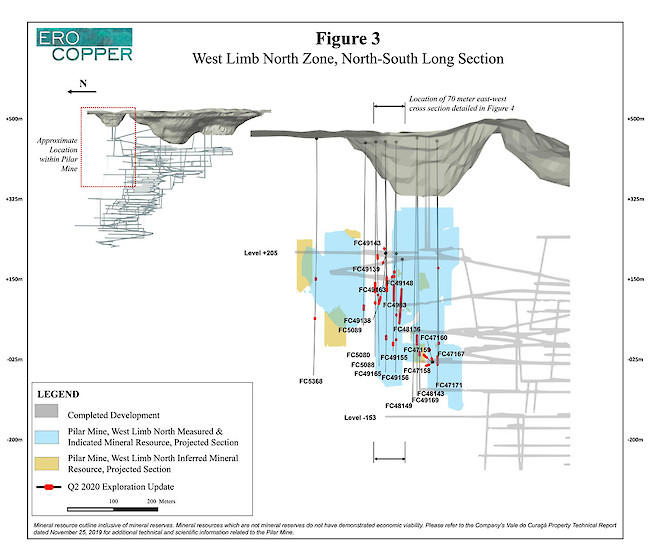

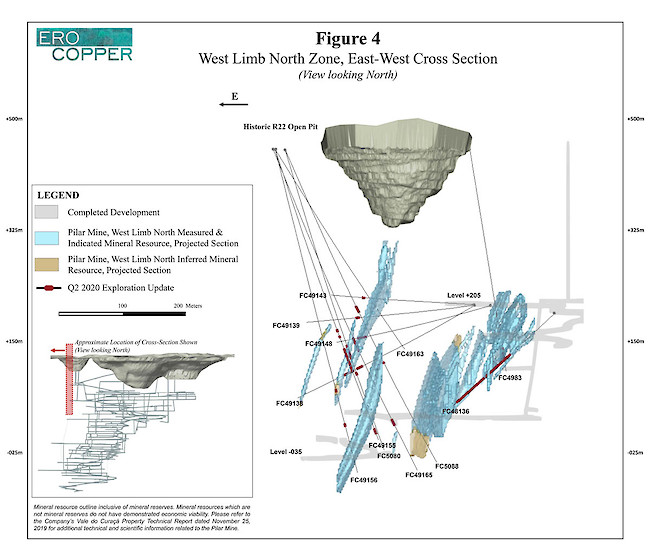

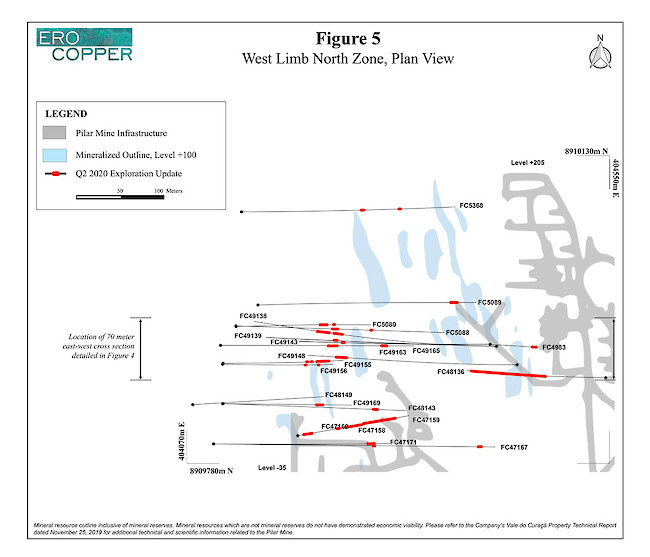

- New drilling, based on ongoing data compilation work, has demonstrated an extended zone of thicker mineralization in an area previously modeled as discontinuous lenses within the northern known extent of the Pilar Mine. Mineralization in this area, known as “West Limb North”, runs parallel and in close proximity to the mineralized lenses comprising the East Limb and the planned mining stopes of P1P2W. The zone is located approximately 350 meters below surface and approximately 150 to 200 meters from the closest access point on level +205 of the Pilar Mine. To date, the known extent of mineralization in this area has been extended by over 40 meters in strike length, over a vertical extent of approximately 140 meters and over an average thickness of approximately 20 to 30 meters with local thicknesses up to 60 meters. The zone remains open to the north. Results are highlighted by:

- FC48136: 113.4 meters grading 1.41% copper, including 67.2 meters grading 1.77% copper, drilled obliquely to the dominant orientation of mineralization in this area, demonstrating vertical continuity and localized thickening of mineralization within the zone;

- FC5080: 24.8 meters grading 2.66% copper including 6.0 meters grading 5.47% copper;

- FC49169: 26.2 meters grading 2.40% copper including 5.0 meters grading 3.59% copper;

- FC47159: 37.7 meter grading 1.76% copper including 12.4 meters grading 2.78% copper; and,

- FC47158: 26.2 meters grading 1.93% copper.

- At the NX Gold Mine, drill results continue to demonstrate down-plunge extensions of the high-grade mineralization of the Santo Antonio Vein. Results are highlighted by:

- SA77: 5.9 meters grading 5.09 grams per tonne, confirming a thicker core of mineralization near previously announced holes SA73 and SA70 (4.9 meters grading 10.21 grams per tonne gold and 4.9 meters grading 9.53 grams per tonne gold, respectively), drilled approximately 30 to 50 meters down-plunge from the limits of the current mineral resource; and,

- SA81: 2.8 meters grading 11.29 grams per tonne gold, located approximately 210 meters down-plunge of the limit of the current inferred mineral resource. This is the deepest intercept drilled in the Santo Antonio Vein to date and is located an additional 140 meters down-plunge from hole SA77.

- Regional work in the Curaçá Valley comprised of both exploration drilling and ground-based geophysical work continues to remain focused on four newly interpreted mineral systems within the portfolio of targets defined by the Company’s comprehensive targeting work. Each of the new systems has an average strike length of 5 kilometers and contains multiple priority drill targets. While preliminary results are encouraging, additional detail on these ongoing exploration programs continues to be expected during the second half of the year.

Commenting on the results, David Strang, President & CEO, stated, “The exploration results highlighted in our second quarter update continue to build upon the success of several critical exploration objectives we set out for the Company during the first half of 2020. These objectives were centered upon continued demonstration of high-grade mineralization within the Deepening Extension Zone of the Pilar Mine, extensions of mineralization at Vermelhos and Siriema and extending the known limits of mineralization at the NX Gold Mine.

We continue to be extremely pleased with the results of drilling from the Deepening Extension Project which now includes the best hole on a grade-meter basis we have drilled as a Company in the Curaçá Valley, as well as new records for the deepest drill results at the Pilar Mine. Our progress at Siriema remains encouraging as we continue to follow the mineralized conduit to depth and to the north, and we are pleasantly surprised by the new drilling within the West Limb North Zone, which appears to be outlining potential for a new, higher-grade zone of near surface mineralization. In addition, the drilling on the Santo Antonio Vein at our NX Gold Mine continues to expand the known extent of mineralization well outside of the current mineral resource.

The Curaçá Valley and the NX Gold Mine continue to deliver spectacular results and demonstrate that many of our near-mine targets remain wide-open. The breadth of organic growth opportunities available to the Company give us confidence that our near-mine programs will continue to deliver on our core objectives as we progress to more regional drilling during the second half of the year. We continue to see the emergence of four key regional mineralized systems on which we are focusing our regional exploration efforts in the near to medium-term.

As a testament to the quality of our operating and exploration teams in Brazil, the COVID-19 pandemic continues to have minimal impact on our planned exploration programs to date. Additionally, in early June we began to see progress and the initial, yet incomplete, results for our pending cobalt, gold and PGM assays at Siriema previously delayed due to global third-party laboratory closures. We expect that we will obtain many of these delayed sample batches in the coming months, provided these laboratories continue to remain open while we build this capability in house for the future.”

Twenty-seven drill rigs are currently operating in the Curaçá Valley, including twelve within the Pilar District, eleven in the Vermelhos District, and there are currently six drill rigs (including two within the Vermelhos District) operating on regional exploration targets in the Curaçá Valley. Five additional drill rigs are currently operating at the NX Gold Mine.

Expansions and extensions, as referenced herein, reflect mineralization not captured in the Company’s mineral resource and mineral reserve models used in the current (2019) mineral resource and reserve estimate. There has been insufficient work and analysis surrounding new discoveries, as referenced herein, to define a mineral resource and it is uncertain if further exploration and analysis will result in such targets being delineated as a mineral resource.

The drill holes outlined in this press release within the Vermelhos and Pilar Districts will be made available on the Company’s Curaçá Valley site tour and interactive three-dimensional models for the Pilar Mine and the Vermelhos System, which can be accessed via the Company’s website (www.erocopper.com) or via VRIFY Technology Inc. (“VRIFY”) (www.vrify.com).

PILAR DISTRICT

The Pilar District encompasses the area surrounding the Pilar underground mine, Caraíba Mill complex and the past producing Pilar open pit and R22 Mines. Twelve drill rigs are currently focused on resource upgrade and exploration programs within the Pilar Mine.

During the period, the Company has continued to prioritize drilling of the Deepening Extension where the Company continues to confirm thick and high-grade mineralization of a recently identified mineralized chamber, or “Superpod”, within the Deepening Extension zone.

The Deepening Extension

Deepening Extension drilling is currently targeting mineralization on the East Limb of the Pilar Mine between level -725 and level -1400 approximately 1,200 meters to 2,000 meters below surface and approximately 100 meters laterally from the current level of the primary ramp (completed to level -940). Drilling in the Deepening Extension zone continues to extend the known limits of high-grade copper mineralization of the mine and has continued to intercept some of the most significant holes on a grade-meter basis drilled in the Pilar Mine since acquisition of the Vale do Curaçá Property in 2016, including the highest intercept on a grade-meter basis drilled in the Curaçá Valley to date, confirming continuity within a high-grade, mineralized chamber, or “Superpod”.

The Company has now identified a mineralized area within the Deepening Extension zone that extends over approximately 800 meters in strike length, over a total depth of approximately 500 meters and over an average thickness of approximately 15 to 20 meters with localized thicknesses in excess of 50 meters. Within the total strike length, a higher-grade continuous zone with a strike-length of approximately 400 to 500 meters is emerging in the central and northern segments of the target area. The zone remains open to the north and to depth. There are currently six underground exploration drill rigs systematically drilling the defined exploration target area within the Deepening Extension zone.

New results during the period are highlighted by notable confirmatory and extensional drilling within the high-grade target area. In the northern section of the target area, new results are highlighted by hole FC5625 that intersected 96.4 meters grading 3.97% copper including 60.6 meters grading 5.61% copper, which is the highest grade-meter intercept drilled by the Company to date. This results is complemented by previously released intercepts, also on section 56, of hole FC5623 that intersected 21.8 meters grading 2.27% copper including 2.8 meters grading 7.76% copper, hole FC5616 that intersected 51.8 meters grading 3.49% copper including 33.4 meters grading 4.96% copper and hole FC5615 that intersected 62.5 meters grading 1.65% copper including 26.1 meters grading 2.37% copper.

Approximately 135 meters south of section 56, on section 53 in the center of the higher-grade continuous zone, new drilling sought to test the known limits of the Deepening Extension zone to depth. The results are highlighted by hole FC5367 that intercepted 29.9 meters grading 5.90% copper including 6.0 meters grading 7.04% copper, which is the deepest intercept drilled by the Company in the Pilar mine to-date and is located approximately 540 meters below the current level of the primary ramp, and approximately 100 meters below the Company’s previously announced deepest intercept in hole FC47144.

In the central portion of the Deepening Extension, located approximately 400 meters south of the intercepts noted previously on section 56, new results are highlighted by hole FC47165 that intersected 19.6 meters grading 3.61% copper including 10.0 meters grading 5.09% copper and hole FC47169 that intersected 10.0 meters grading 6.27% copper including 5.0 meters grading 7.82% copper. Drill results in the central portion of the Deepening Extension are complemented by previously announced intercepts, also on section 47, in hole FC47163 that intersected 22.8 meters grading 3.18% copper including 10.6 meters grading 5.29% copper, hole FC47143 that intersected 37.0 meters grading 1.49% copper including 5.0 meters grading 2.92% copper, hole FC47142 that intersected 34.7 meters grading 2.29% copper including 18.6 meters grading 3.15% copper, and hole FC47139 that intersected 7.1 meters grading 6.50% copper including 4.1 meters grading 9.01% copper (please refer to the Company’s press releases dated September 12, 2019, December 3, 2019 and April 22, 2020 for previously announced Deepening Extension results).

Exploration results from the Deepening Extension during the period continue to provide evidence that the Pilar Mine remains open to depth, where high-grade mineralization continues to be encountered, including the deepest intercept drilled in the Pilar Mine to date in hole FC5367. Due to the limits of underground infrastructure to the north, the Company has commenced a surface drill program utilizing directional drilling technology to evaluate the mineralized potential of the Deepening Project north of section 57, the most northern extent of known mineralization to date.

Please see Figure 1 for a north-south long section and Figure 2 for a level map showing collar locations of Deepening Extension drilling within the Pilar Mine.

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) |

|---|---|---|---|---|

| FC45168 | 131.7 | 135.0 | 3.3 | 2.71 |

| FC45169 | 279.3 | 302.5 | 23.1 | 1.28 |

| including | 279.3 | 283.3 | 4.0 | 1.91 |

| FC47165 | 481.8 | 501.4 | 19.6 | 3.61 |

| including | 483.3 | 493.3 | 10.0 | 5.09 |

| FC47166 | 459.7 | 468.5 | 8.9 | 2.99 |

| including | 464.7 | 467.7 | 3.0 | 5.46 |

| and | 477.5 | 498.5 | 21.0 | 1.96 |

| including | 481.8 | 487.8 | 6.0 | 3.03 |

| FC47169 | 501.8 | 511.8 | 10.0 | 6.27 |

| including | 505.8 | 510.8 | 5.0 | 7.82 |

| and | 577.1 | 584.6 | 7.5 | 2.40 |

| including | 577.7 | 579.6 | 2.0 | 6.53 |

| and | 594.6 | 599.9 | 5.3 | 2.60 |

| and | 634.9 | 653.9 | 19.0 | 1.07 |

| and | 689.9 | 720.5 | 30.6 | 1.29 |

| FC47170 | 534.2 | 544.1 | 9.9 | 1.17 |

| and | 548.1 | 555.1 | 7.0 | 1.35 |

| and | 570.6 | 576.1 | 5.6 | 1.64 |

| FC5364 | NSI | NSI | NSI | NSI |

| FC5366 | 609.7 | 617.2 | 7.5 | 3.09 |

| FC5367 | 780.3 | 785.3 | 5.0 | 1.19 |

| and | 805.0 | 834.8 | 29.9 | 5.90 |

| including | 809.0 | 815.0 | 6.0 | 7.04 |

| FC5621 | 619.4 | 628.9 | 9.4 | 3.62 |

| FC5624 | 475.8 | 480.9 | 5.1 | 3.79 |

| and | 476.8 | 479.8 | 3.0 | 5.24 |

| and | 503.0 | 506.7 | 3.7 | 1.97 |

| FC5625 | 600.1 | 696.5 | 96.4 | 3.97 |

| including | 615.8 | 676.5 | 60.6 | 5.61 |

NSI indicates no significant intercept based on a three meter mining width and cut-off grade of 0.68% copper. Drill holes were drilled from level -670, level -740 and level -875 in the Pilar Mine. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

West Limb North

Ongoing data compilation work combined with new drilling has resulted in the delineation of a zone of thicker and continuous mineralization within the Pilar Mine at the northern extent of known mineralization in an area previously modeled as lower grade, discrete and discontinuous lenses. Mineralization in this area, known as West Limb North, runs parallel and in close proximity to the mineralization and planned mining stopes of P1P2W on the East Limb of the Pilar Mine. The zone is located approximately 350 meters below surface in the upper levels of the mine (beneath the R22 open pit) and approximately 150 to 200 meters from the closest access point on level +205 of the Pilar Mine. To date, new drilling has extended the known limits of mineralization by over 40 meters in strike length, approximately 140 meters in vertical extent and over an average thickness of approximately 20 to 30 meters with local thicknesses of up to 60 meters. The zone remains open to the north.

Drilling during the period is highlighted by hole FC48136 that intersected 113.4 meters grading 1.41% copper, including 67.2 meters grading 1.77% copper. This hole was drilled at a new orientation that is oblique relative to the dominant plunge of mineralization, demonstrating vertical continuity and localized thickening of mineralization within the zone. In addition, several drill holes, located approximately 45 meters north and 200 meters west of the intercept in hole FC48136, were drilled perpendicular to the dominant plunge of mineralization and are indicative of average true widths in this area. These results are highlighted by hole FC5080 that intersected 24.8 meters grading 2.66% copper including 6.0 meters at 5.47% copper, hole FC49169 that intersected 26.2 meters grading 2.40% copper including 5.0 meters grading 3.59% copper, and hole FC47159 that intersected 37.7 meter grading 1.76% copper including 12.4 meters grading 2.78% copper.

The potential significance of the new results within the West Limb North zone is that they define new extensions of the planned mining stopes of P1P2W, a portion of which are currently being prepared for mining. The proximity to surface and existing infrastructure in this area, allows for mined tonnages to be either hauled to surface via the primary ramp, or trucked down-hill to the underground crusher, both at relatively low transport cost and enhanced operational flexibility.

Please see Figure 3 for a north-south long section, Figure 4 for an east-west cross section and Figure 5 for a level map showing collar locations of the West Limb North drilling within the Pilar Mine.

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) |

|---|---|---|---|---|

| FC47167 | 327.2 | 331.2 | 4.0 | 0.96 |

| and | 529.7 | 535.8 | 6.2 | 1.75 |

| FC47171 | 496.4 | 520.0 | 23.5 | 1.59 |

| FC47158 | 53.4 | 79.6 | 26.2 | 1.93 |

| FC47159 | 5.0 | 9.1 | 4.1 | 1.10 |

| and | 77.1 | 114.8 | 37.7 | 1.76 |

| including | 86.4 | 98.8 | 12.4 | 2.78 |

| FC47160 | 10.5 | 20.1 | 9.6 | 2.04 |

| and | 52.9 | 58.0 | 5.1 | 1.80 |

| FC48136 | 93.3 | 206.8 | 113.4 | 1.41 |

| including | 105.5 | 172.7 | 67.2 | 1.77 |

| FC49138 | 198.6 | 209.6 | 11.0 | 0.76 |

| and | 214.4 | 232.0 | 17.6 | 2.35 |

| FC49139 | 179.9 | 186.9 | 7.0 | 1.80 |

| FC48143 | 494.8 | 505.6 | 10.8 | 1.47 |

| FC48149 | NSI | NSI | NSI | NSI |

| FC49143 | 170.5 | 175.4 | 4.9 | 1.75 |

| FC49148 | 199.0 | 214.4 | 15.4 | 1.18 |

| and | 210.5 | 214.4 | 3.9 | 2.05 |

| FC49155 | 296.0 | 301.0 | 5.0 | 1.39 |

| and | 307.0 | 311.0 | 4.0 | 0.77 |

| and | 328.0 | 367.6 | 39.5 | 1.23 |

| including | 365.0 | 367.6 | 2.6 | 5.15 |

| and | 461.2 | 471.2 | 10.0 | 1.26 |

| FC49156 | 385.1 | 390.7 | 5.6 | 1.24 |

| and | 440.5 | 446.5 | 6.0 | 2.35 |

| including | 443.5 | 446.5 | 3.0 | 3.33 |

| FC49163 | NSI | NSI | NSI | NSI |

| FC49165 | 318.4 | 342.6 | 24.3 | 1.53 |

| and | 459.1 | 470.9 | 11.8 | 1.20 |

| FC49169 | 439.8 | 464.8 | 26.2 | 2.40 |

| including | 456.8 | 461.8 | 5.0 | 3.59 |

| FC4983 | 313.1 | 317.4 | 4.3 | 0.92 |

| and | 320.4 | 330.4 | 10.0 | 1.94 |

| including | 322.3 | 324.7 | 2.4 | 3.57 |

| FC5080 | 318.7 | 343.5 | 24.8 | 2.66 |

| including | 330.5 | 336.5 | 6.0 | 5.47 |

| and | 363.5 | 369.5 | 6.1 | 1.95 |

| including | 365.5 | 368.5 | 3.0 | 3.05 |

| FC5088 | 267.0 | 279.0 | 12.0 | 1.50 |

| and | 364.3 | 367.7 | 3.4 | 1.72 |

| FC5089 | 415.6 | 429.0 | 13.4 | 2.52 |

| including | 422.6 | 427.6 | 5.0 | 3.94 |

| FC5368 | 320.8 | 327.4 | 6.6 | 1.09 |

| and | 418.1 | 422.1 | 4.0 | 0.82 |

NSI indicates no significant intercept based on a three meter mining width and cut-off grade of 0.68% copper. Drill holes were drilled from surface, level -35, level +190 and level +205 in the Pilar Mine. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

VERMELHOS DISTRICT

The Vermelhos District is located approximately eighty kilometers to the north of the Pilar Mine and Caraíba Mill complex and includes the operating high-grade Vermelhos Mine. Drilling is focused on both near-mine extensional drilling as well as new regional targets identified during the Company’s regional airborne survey and subsequent data compilation work of the broader Vermelhos System – a north-south trend encompassing the Vermelhos Mine, East Zone, Siriema N8/N9 deposit, and several high priority targets that extends over ten kilometers in strike length.

Eleven drill rigs are currently operating in the district including seven focused on upgrade and exploration programs within and adjacent to the Vermelhos Mine, including the Siriema deposit, while two rigs are focused on regional targets within Vermelhos System trend.

Siriema

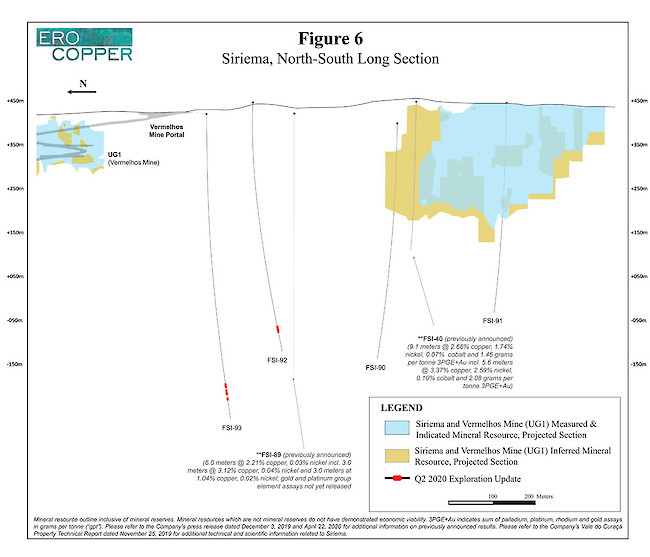

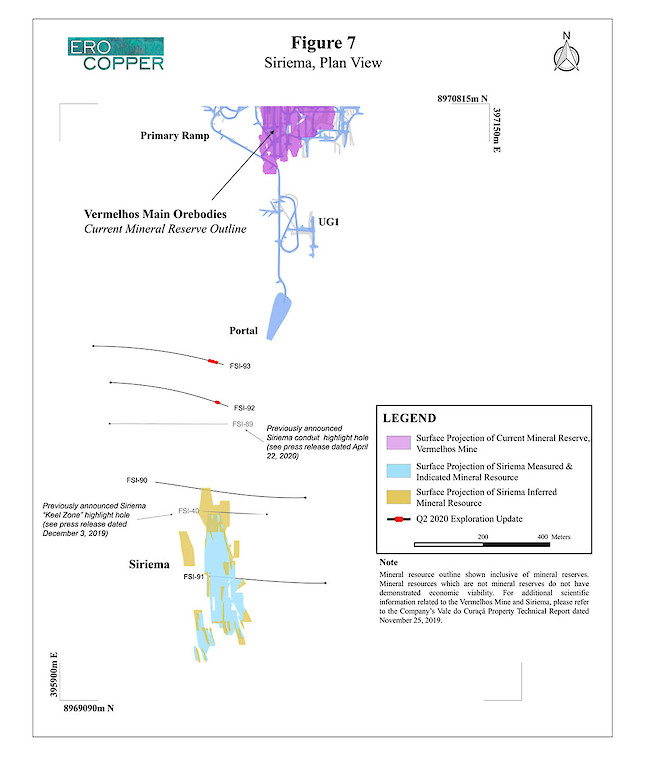

The Siriema deposit is the Company’s first regional discovery (see press release dated July 30, 2019 for the announcement of the Siriema discovery) and is located approximately 1.5 kilometers south of the Vermelhos Mine. The exploration drill program at Siriema is focused on continuing to extend the known limits of mineralization within the Siriema conduit – a north-plunging mineralized controlling structure comprised of both disseminated and massive sulphide mineralization, including the massive sulphide breccia zone of elevated copper, nickel, cobalt and platinum group metals (“PGMs”) of the Keel Zone (please refer to the Company’s press release dated December 3, 2019 for previously released multi-element intercepts).

During the period, wide-spaced, down-plunge, 200 meter step-out exploration drilling at Siriema continued to operate as planned, and continued to intercept the previously identified controlling mineralized Siriema conduit at depth. To date, mineralization has now been encountered from surface to a depth of approximately 620 meters below surface and over variable thicknesses from sub 1 meter up to 20 meters. The Siriema deposit remains open to depth and to the north where drilling and down-hole electromagnetic (“EM”) work continue to evaluate the potential for higher-grade and thicker mineralization.

As a whole, mineralization encountered within the conduit continues to be comprised of disseminated and massive sulphide mineralization, containing both copper and nickel. Drilling during the period sought to extend the known limit of mineralization within a previously identified deeper zone, located approximately 500 to 650 meters below surface and approximately 400 meters beneath the current mineral resource limit. Continued extensional results are demonstrated in hole FSI-92 that intersected 17.0 meters grading 0.78% copper including 7.0 meters grading 1.23% copper and hole FSI-93 that intersected 12.8 meters grading 0.68% copper including 6.0 meters grading 1.00% copper. These results are located approximately 370 meters and 550 meters down-plunge from the limit of the current mineral resource; respectively. The intercept of hole FSI-93 is located approximately 620 meters below surface, making it the deepest known intercept within the Siriema conduit to date. These results are complemented by the previously announced deepest Siriema intercept in hole FSI-89 that intersected 6.0 meters grading 2.21% copper and 0.03% nickel including 3.0 meters grading 3.12% copper and 0.04% nickel, located approximately 180 meters south of FSI-93 (see the Company’s press release dated April 22, 2020 for complete results).

Intercepts below three meters in thickness drilled within the Siriema conduit are reported below as not significant, consistent with the Company’s minimum mining thickness and overall approach to reporting exploration drill results. Further, as a result of the COVID-19 pandemic and global third-party laboratory closures, assay results for cobalt, PGMs and gold during the period, as well as pending samples from previously released holes continue to be delayed. With third-party laboratories recommencing operations during the period, the Company expects to receive these pending assay results in the coming months.

Please see Figure 6 for a north-south long section and Figure 7 for a plan map detailing Siriema collar locations.

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) | Ni (%) |

|---|---|---|---|---|---|

| FSI-90 | NSI | NSI | NSI | NSI | NSI |

| FSI-91 | NSI | NSI | NSI | NSI | NSI |

| FSI-92 | 596.8 | 613.8 | 17.0 | 0.78 | 0.02 |

| including | 601.8 | 608.8 | 7.0 | 1.23 | 0.02 |

| FSI-93 | 700.9 | 711.9 | 11.0 | 0.57 | 0.01 |

| and | 717.5 | 730.3 | 12.8 | 0.68 | 0.04 |

| including | 722.5 | 728.5 | 6.0 | 1.00 | 0.02 |

| and | 739.3 | 743.3 | 4.0 | 1.02 | 0.02 |

NSI indicates no significant intercept, based on a three meter mining width and cut-off grade of 0.18% copper for all intervals, including to depth. Drill holes were drilled from surface. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

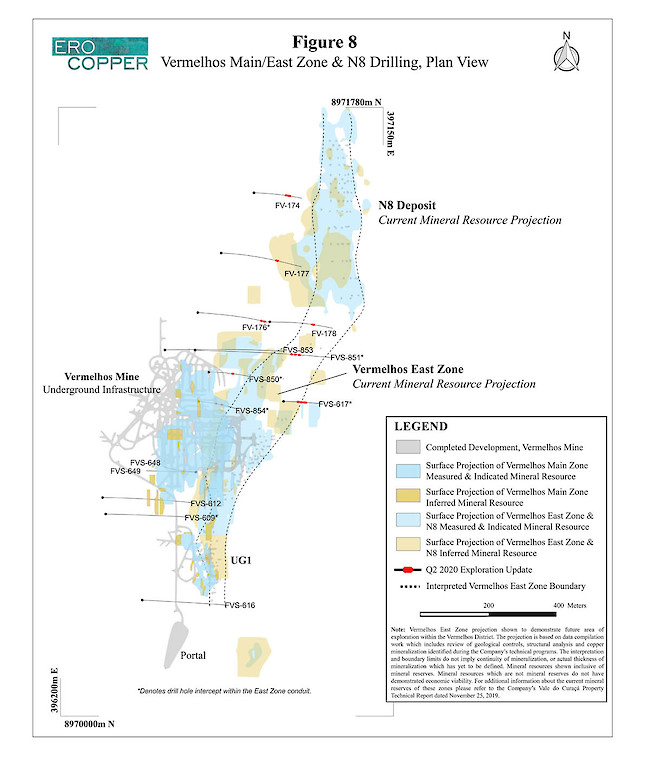

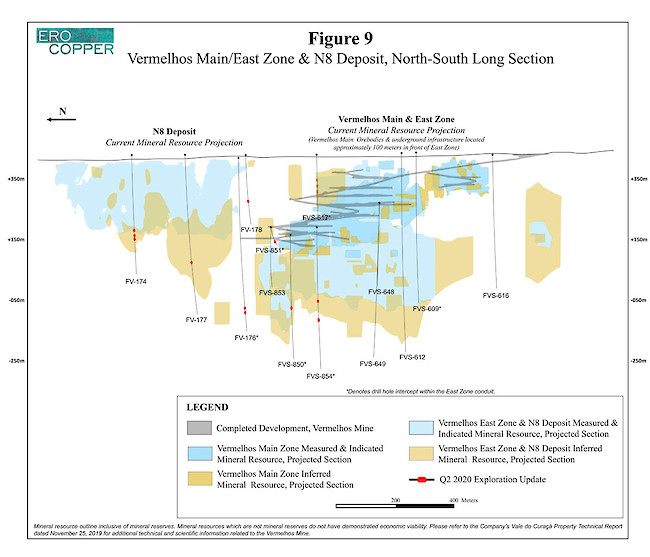

Vermelhos Near-Mine Programs

Drilling during the period in and around the Vermelhos Mine was focused on both infill drilling for mine planning and extensions of (i) the limits of known mineralization surrounding the main Vermelhos orebodies to depth with systematic fan drilling, (ii) the East Zone conduit and (iii) extensions of the N8 Deposit (the western portion of the adjacent N8/N9 deposits, previously referred to as Vermelhos West). Drilling continues to demonstrate continuity of mineralization throughout the Vermelhos System. Additional drilling and borehole EM work remains ongoing.

At the Vermelhos Mine, the first systematic fan drilling exploration program that commenced in Q1 2020 continued to progress. To date, approximately 25% of the program has been completed and it is now expected to run through the end of 2020. Access for follow-up drilling in the central area of this program, where several high-grade intercepts were previously encountered including FVS-465 (13.4 meters grading 5.86% copper including 8.4 meters grading 7.04% copper) and FVS-638 (7.2 meters grading 2.16% copper including 2.0 meters grading 4.62% copper), was not possible due to the prioritization of production activities in the same area during the period. As a result, drill rigs were moved to the northern and southern sections of the planned fan drill program and only several holes were drilled during the period.

In addition, drilling during the period sought to extend the known limits of the East Zone conduit, a zone of mineralization that has now been delineated from surface copper oxide mineralization to a depth of approximately 575 meters below surface and over a combined strike length of approximately 1.7 kilometers. Although there is no dedicated East Zone drill program outside of the UG3 mining area and the south extensions of the N8 Deposit, short-term holes drilled for mine planning at Vermelhos as well as those drilled on the eastern side of the main deposit as part of the systematic fan drill exploration program are typically extended approximately 150 meters beyond the primary exploration target zones in order to evaluate mineralized potential within the East Zone. Several new intercepts during the period continue to demonstrate continuity within this zone.

At the N8 Deposit, drilling during the period continued to extend the known limits of mineralization to the south connecting the N8 Deposit to the East Zone conduit and linking the N8 deposit to the UG1 mining area.

Please see Figure 8 for a plan map detailing all Vermelhos near-mine collar locations and Figure 9 for north-south long section detailing all Vermelhos near-mine drilling.

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) |

|---|---|---|---|---|

| Vermelhos Mine & East Zone Extension Drilling | ||||

| FVS-648 | NSI | NSI | NSI | NSI |

| FVS-649 | NSI | NSI | NSI | NSI |

| FVS-850* | 253.4 | 260.4 | 7.0 | 0.98 |

| FVS-854* | 251.2 | 254.2 | 3.0 | 1.17 |

| and | 310.7 | 320.4 | 9.7 | 1.71 |

| FV-176* | 533.1 | 536.1 | 3.0 | 0.96 |

| and | 547.3 | 552.3 | 5.0 | 0.78 |

| FVS-609* | 542.2 | 548.3 | 6.1 | 0.69 |

| FVS-612 | NSI | NSI | NSI | NSI |

| FVS-616 | NSI | NSI | NSI | NSI |

| FVS-617* | 91.3 | 97.4 | 6.1 | 0.58 |

| and | 111.4 | 125.9 | 14.5 | 0.47 |

| including | 111.4 | 114.4 | 3.0 | 0.89 |

| and | 130.9 | 143.9 | 13.0 | 0.42 |

| FVS-851* | 281.2 | 288.2 | 7.0 | 0.77 |

| and | 292.2 | 297.2 | 5.0 | 1.07 |

| and | 305.8 | 308.8 | 3.0 | 0.73 |

| FVS-853 | NSI | NSI | NSI | NSI |

| N8 Deposit Drilling | ||||

| FV-174 | 267.2 | 270.2 | 3.0 | 0.74 |

| and | 283.8 | 289.0 | 5.2 | 0.96 |

| and | 296.0 | 302.2 | 6.2 | 1.38 |

| FV-177 | 391.0 | 398.0 | 7.0 | 1.18 |

| including | 395.0 | 397.0 | 2.0 | 1.80 |

| FV-178 | 200.5 | 203.4 | 3.0 | 1.31 |

(*) Denotes drill hole intercept within the East Zone conduit. NSI indicates no significant intercept, based on a three meter mining width and a cut-off grade of 0.18% copper for near-surface intervals and 0.68% for intervals below 200 meters down hole. Drill holes were drilled from surface and from level +185, level +210, level +215, level 225 and level +250 in the Vermelhos Mine. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

REGIONAL EXPLORATION

Regional work comprised of both exploration drilling and ground-based geophysical work is currently focused on four newly interpreted mineral systems identified in the Curaçá Valley. These new systems have been defined by semi-continuous geochemistry / geophysical anomalies as well as structural data interpretation similar to the work undertaken to define the Vermelhos System. These four new systems have an average strike length of over 5 kilometers and, similar to the Vermelhos System, each contain multiple priority drill targets. Two of these new regional systems are located within the northern Vermelhos District and two are located within the central Surubim District. While preliminary results are encouraging, additional drilling is required to further understand the extent and potential size of targets within each system prior to their release which is expected during the second half of the year, consistent with the Company’s approach for releasing exploration drill results on new target areas.

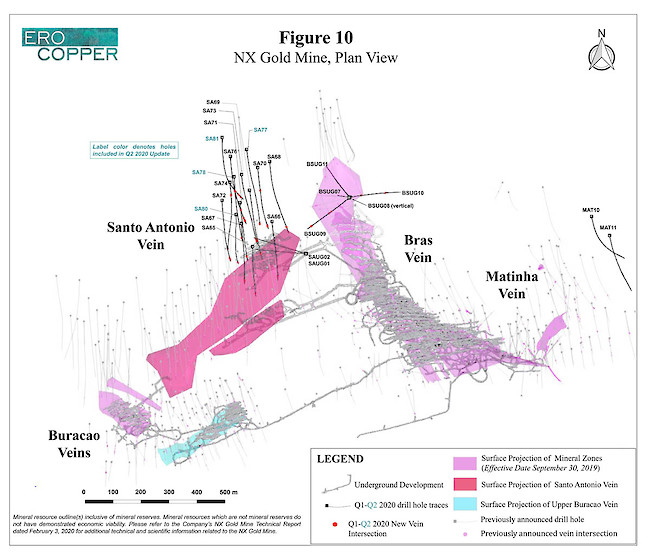

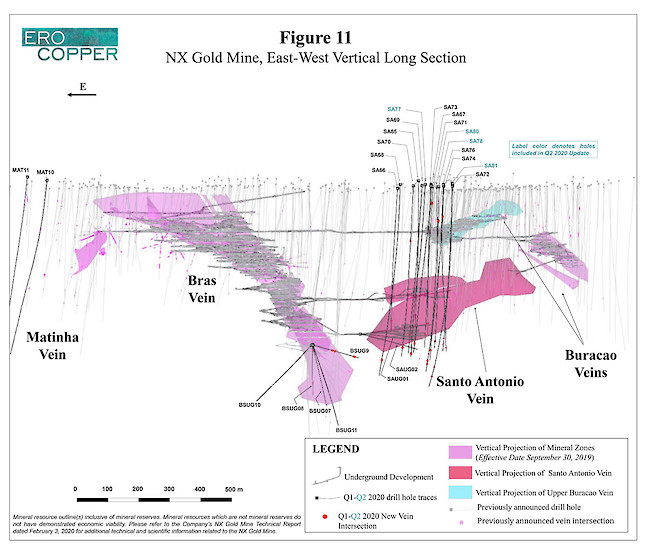

NX GOLD MINE

The NX Gold Mine is a high-grade producing gold mine, located in Mato Grosso State, Brazil. Beginning in late 2018, a comprehensive in-mine exploration program commenced for the first time since the mine was commissioned in 2012 that resulted in the Santo Antonio Vein discovery. In late 2019, all mining activity was transitioned from the Brás and Buracão Veins into the Santo Antonio Vein. To date, the Santo Antonio Vein has been defined over a lateral extent of approximately 400 meters, a down-dip distance of approximately 325 meters and remains open to depth (see press release dated April 18, 2019 for detail regarding the Santo Antonio Vein discovery).

Drilling during the period was primarily focused on continuing to test down-plunge extensions of the Santo Antonio Vein. Results are highlighted by hole SA77 that intersected 5.9 meters grading 5.09 grams per tonne, confirming a thicker core of mineralization near previously announced holes SA73 and SA70 that intersected 4.9 meters grading 10.21 grams per tonne gold and 4.9 meters grading 9.53 grams per tonne gold, respectively (please see the Company’s press released dated April 22, 2020 for complete results). Each of these holes were drilled approximately 30 to 50 meters down-plunge from the limits of the current mineral resource. Approximately 140 meters down plunge from the thicker core of mineralization identified in hole SA77, hole SA81 intersected 2.8 meters grading 11.29 grams per tonne gold. This new intercept is located approximately 210 meters down-plunge from the limit of the current inferred mineral resource, and is the deepest intercept drilled to date in the Santo Antonio Vein.

In total, new results during the period have increased the known extent of mineralization within the Santo Antonio Vein down-plunge by a total of approximately 210 meters and over a strike length of approximately 160 meters. The vein remains open to depth. Currently, five drill rigs are operating on the property.

Please refer to Figure 10 for drill collar locations and Figure 11 for an east-west vertical long-section of the NX Gold Mine.

| Hole ID | From (m) | To (m) | Length (m) | Au (gpt) |

|---|---|---|---|---|

| SA77 | 607.4 | 613.3 | 5.9 | 5.09 |

| SA78 | 572.0 | 574.9 | 2.9 | 10.25 |

| SA80 | NSI | NSI | NSI | NSI |

| SA81 | 665.1 | 667.9 | 2.8 | 11.29 |

NSI indicates no significant intercept, based on cut-off grade of 1.40 grams per tonne gold. Drill holes were drilled from surface. The length of intercept may not represent the true width of mineralization and reported intercepts reflect the entire thickness of the vein. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

NOTE ON NI 43-101 COMPLIANT TECHNICAL REPORT(S)

The conversion of drill results presented in this press release into National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant mineral resources and mineral reserves, including but not limited to the drill results associated with the new and potential extensions of mineralization across each of the mineral districts outlined in this press release, all require additional work and analysis that remains ongoing. To date, there has been insufficient exploration and accompanying analysis to define a mineral resource and it is uncertain if further exploration will result in these extensions being delineated as a mineral resource. Accordingly, the results herein may not be included in future NI 43-101 compliant mineral resources or mineral reserves depending on the results of this additional work and analysis, and other technical and/or economic reasons.

QUALITY ASSURANCE / QUALITY CONTROL

Vale do Curaçá Property

The Company is currently drilling on surface and underground with core drill rigs using a combination of owned and third-party contracted drill rigs. During the period from March 2020 through early June 2020 third-party drill rigs were operated by Major Drilling do Brasil Ltda., Tamarama Sondagens Ltda., Layne Christensen Co., and DrillGeo Geologia e Sondagem Ltda., all of whom are independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at the secure core logging and storage facilities of Mineração Caraíba S.A. (“MCSA”). Half of the drill core is retained on site and the other half core is used for analysis, with samples collected on one-meter sample intervals unless an interval crosses a geological contact. Reverse circulation cuttings are split at the drill rig using one-meter sample intervals. All sample preparation is performed in MCSA’s secure on-site laboratory. Total copper is determined using a nitric-hydrochloric acid digestion and Atomic Absorption Spectrometry (“AAS”) and/or Titration. Oxide copper values are determined using sulfuric acid digestion followed by AAS. All sample results during the period have been monitored through a quality assurance – quality control (“QA/QC”) program that includes the insertion of certified standards, blanks, and pulp and reject duplicate samples. Regular check-assays are submitted to ALS Brasil Ltda’s facility located in Vespasiano, Minas Gerais, Brazil, at a rate of approximately 5%. ALS Brasil Ltda is a subsidiary of ALS Limited and is independent of the Company.

All nickel, cobalt, gold and PGM results, where applicable, are prepared and analyzed by ALS Limited’s facilities located in Lima, Peru and Vancouver, British Columbia. Gold, platinum and palladium values are calculated by ALS Global’s facility in Lima, Peru using acid digestion and inductively coupled plasma atomic emission spectroscopy (“ICP-AES”). Nickel and cobalt values are determined at the same facility using acid digestion followed by ICP-AES and inductively coupled plasma mass spectroscopy (“ICP-MS”) plus AAS for assay values above 1%. Rhodium values are determined by ALS Global’s facility in Vancouver, British Columbia using fire assay and ICP-MS. ALS Global is independent of the Company.

NX Gold Mine

The Company is currently drilling on surface with third-party contracted core drill rigs. During the period from March 2020 through early June 2020 third-party drill rigs were operated by Servitec Foraco Sondagem S.A. who is independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at NX Gold’s secure core logging and storage facilities. Half of the drill core is retained on site and the other half core is used for analysis, with samples collected on half-meter sample intervals for quartz vein and one-meter intervals in surrounding rock unless such interval crosses a geological contact. Samples are sent to ALS Brasil Ltda.’s laboratory in Goiânia (Brazil) for preparation and are analyzed by the certified laboratory of ALS Peru S.A., whom are independent of the Company. During the period, gold content has been determined by both fire assay and screen fire assay. All sample results during the period have been monitored through a QA/QC program that includes the insertion of certified standards, blanks, and pulp and reject duplicate samples at a rate of one standard, one blank, and one duplicate pulp sample per every 20 samples for a blended rate of approximately 5%.

Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission) and Resource Manager of the Company who is a “qualified person” within the meanings of NI 43-101, has reviewed and approved the disclosure of technical information, including verification of the sampling, analytical and testing data in this press release. Quarterly reviews entail sampling and laboratory procedure review as well as verification of original assay certificates associated with a selection of samples from Company’s internal database included in this press release.

ABOUT ERO COPPER CORP

Ero Copper Corp, headquartered in Vancouver, B.C., is focused on copper production growth from the Vale do Curaçá Property, located in Bahia, Brazil. The Company’s primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the Vale do Curaçá Property with over 40 years of operating history in the region. The Company currently mines copper ore from the Pilar and Vermelhos underground mines. In addition to the Vale do Curaçá Property, MCSA owns 100% of the Boa Esperanҫa development project, an IOCG-type copper project located in Pará, Brazil and the Company, owns 97.6% of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including Technical Reports on the Vale do Curaçá, Boa Esperanҫa and NX Gold properties, can be found on the Company’s website (www.erocopper.com) and on SEDAR (www.sedar.com).

| ERO COPPER CORP. | |

| Signed: “David Strang” | For further information contact: |

| David Strang, President & CEO | Makko DeFilippo, Vice President, Corporate Development |

| (604) 429-9244 | |

| info@erocopper.com |

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS This Press Release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information includes statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking information includes, without limitation, statements with respect to the estimation of mineral reserves and mineral resources, the significance of any particular exploration program or result and the Company’s expectations for current and future exploration plans including, but not limited to, planned areas of additional exploration, the significance of any drill results or new discoveries and targets, including without limitation extensions of defined mineralized zones, possibilities for mine life extensions or continuity of high-grade mineralization, the recoverable value of any metals other than copper, further extensions and expansion of mineralization near the Company’s existing operations and throughout the Curaçá Valley or the NX Gold Mine and the impact of the COVID-19 pandemic on the Company’s planned drill programs.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this Press Release including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Vale do Curaçá Property, NX Gold Mine and the Boa Esperanҫa Property being as described in the technical reports for these properties; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continues to remain healthy in the face of prevailing epidemics, pandemics or other health risks; political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. Such risks include, without limitation the risk factors listed under the heading “Risk Factors” in the Annual Information Form of the Company for the year ended December 31, 2019, dated March 12, 2020.

Although the Company has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking information, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking information contained herein is made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking information, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

GENERAL Information of a scientific or technical nature in respect of the Vale do Curaçá Property included in this press release is based upon the Vale do Curaçá technical report entitled “2019 Updated Mineral Resources and Mineral Reserves Statements of Mineração Caraíba’s Vale do Curaçá Mineral Assets, Curaçá Valley”, dated November 25, 2019 with an effective date of September 18, 2019, prepared by Rubens Jose De Mendonça, MAusIMM, of Planminas – Projetos e Consultoria em Mineraҫão Ltda. and Porfirio Cabaleiro Rodrigues, MAIG, Leonardo de Moraes Soares, MAIG, and Bernardo Horta de Cerqueira Viana, MAIG, all of GE21 Consultoria Mineral Ltda., whom are independent qualified persons under NI 43-101. Information of a scientific or technical nature in respect of the NX Gold Mine included in this press release is based upon the NX Gold Mine technical report entitled “Mineral Resource and Mineral Reserve Estimate of the NX Gold Mine, Nova Xavantina”, dated February 3, 2020 with an effective date of September 30, 2019, prepared by Porfirio Cabaleiro Rodrigues, MAIG, Leonardo de Moraes Soares, MAIG, and Paulo Roberto Bergmann, FAusIMM, all of GE21 Consultoria Mineral Ltda., whom are independent qualified persons under NI 43-101.

Please see the relevant Technical Reports filed on the Company’s profile at www.sedar.com, for details regarding the data verification undertaken with respect to the scientific and technical information included in this press release regarding the Vale do Curaçá Property and the NX Gold Mine for additional details regarding the related exploration information, including interpretations, the QA/QC employed, sample, analytical and testing results and for additional details regarding the Mineral Resource and Mineral Reserve estimates discussed herein.

Cautionary Notes Regarding Mineral Resource and Reserve Estimates In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with the CIM Standards.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with Measured or Indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an Inferred mineral resource will be upgraded to an Indicated or Measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, Inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.