(all amounts in US dollars, unless otherwise noted)

Vancouver, British Columbia – Ero Copper Corp. (TSX: ERO) (“Ero” or the “Company”) today is pleased to announce its financial results for the three months ended March 31, 2021. Management will host a conference call tomorrow, Wednesday, May 5, 2021, at 11:30 a.m. Eastern time to discuss the results. Dial-in details for the call can be found near the end of this press release.

HIGHLIGHTS

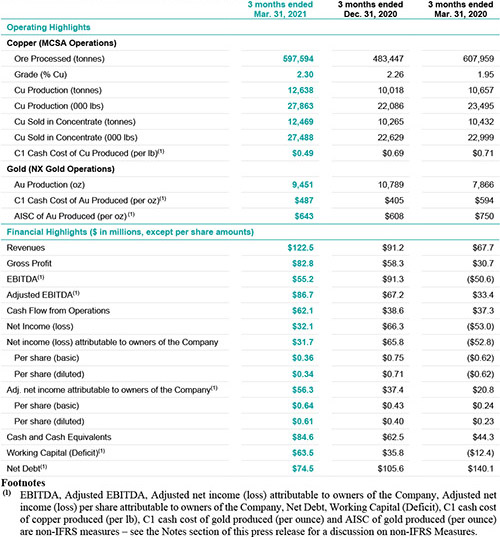

- Record quarterly copper production of 12,638 tonnes and record quarterly C1 cash costs(*) of $0.49 per pound of copper produced driven by strong operational performance including higher grade versus budget at both Pilar and Vermelhos underground mine;

- Strong quarterly gold production of 9,451 ounces from the Santo Antonio Vein at the NX Gold mine at C1 cash costs(*) of $487 per ounce of gold produced and All-in Sustaining Costs(*) of $643 per ounce of gold produced;

- Record quarterly adjusted EBITDA(*) and cash flow from operations of $86.7 million and $62.1 million, respectively;

- Adjusted net income attributable to owners of the Company(*) of $56.3 million ($0.61 per share on a diluted basis);

- Total cash and cash equivalents of $84.6 million, a $22.1 million quarter-on-quarter improvement, and;

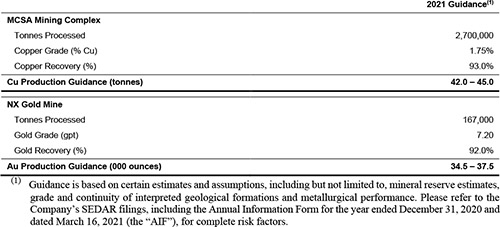

- Reiterating full-year production, operating cost and capital expenditure guidance for 2021.

Commenting on the results, David Strang, CEO, stated, “We have started the year off with considerable momentum, achieving record quarterly copper production and financial performance, a notable accomplishment considering the challenging operating environment our Brazilian colleagues continue to face in mitigating the impacts of COVID-19. As a Company, we are proud of the efforts our team is making to provide critical support to our local communities, and this will remain a top priority this year. At the same time, we are successfully advancing all of our growth initiatives, which, upon completion, will serve to contribute to the long-term and sustainable future of our mines and the regions in which we operate.

“As evidenced by our most recent exploration release, we are making strides in further showcasing the potential and optionality of the Curaçá Valley. So far in 2021, our teams have identified one new discovery beneath the Vermelhos Mine and two new mineralized systems in the Curaçá Valley that have the potential to both extend mine life and support higher mill throughput rates in the future. The discovery beneath the Vermelhos Mine, known as the ‘Novo Zone’, is a high-grade lens that has the potential to improve life-of-mine grades in the near-term and increase overall mine life of the Vermelhos Mine.

“We have also made significant progress around the ongoing optimization initiatives of our Boa Esperanҫa Project and expect to provide an update on what this opportunity looks like during the third quarter. As a reminder, the 2017 feasibility study outlined a low-capital project producing an average of approximately 21,000 tonnes of payable copper per year over a 7.5 year mine life, resulting in a 32.7% internal rate of return. We expect to improve upon this significantly in our 2021 update.

“Other growth projects, including exploration at our NX Gold Mine, with ten drill rigs in operation, and our Platinum Group Metals study, continue to progress despite extended backlogs of assay results at third-party assay labs associated with the COVID-19 pandemic. With strong tailwinds building around a de-carbonized future, which is heavily dependent on copper, we are well positioned as a Company to drive incremental shareholder value through low capital-intensity growth projects across our portfolio.”

*Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, Adjusted net income attributable to owners of the Company, Adjusted net income per share attributable to owners of the Company, C1 Cash Costs per pound of copper produced, C1 Cash Costs per ounce of gold produced and All-in Sustaining Costs (“AISC”) per ounce of gold produced are non-IFRS measures – see the Notes section of this press release for additional information. C1 Cash Costs per pound of copper produced are net of by-product credits from metal produced at the MCSA Mining Complex. AISC per ounce of gold produced are net of by-product credits from metal produced at the NX Gold Mine.

OPERATIONS & EXPLORATION HIGHLIGHTS

- Mining & Milling Operations – record operating performance driven by high copper grades

- The MCSA Mining Complex processed 597,594 tonnes of ore grading 2.30% copper, producing record quarterly 12,638 tonnes of copper in concentrate after metallurgical recoveries of 92.0%.

- The NX Gold Mine processed 37,613 tonnes grading 8.26 grams per tonne, producing 9,451 ounces of gold and 5,794 ounces of silver as a by-product after metallurgical recoveries of 94.7%.

- Exploration Activities at the MCSA Mining Complex – aggressive exploration program generating promising results

- Regional Exploration Program

- Two new mineralized systems identified, each measuring between 800 meters and 2.2 kilometers in strike length.

- Six geochemistry teams, four ground gravity teams and three ground induced polarization teams dedicated to refining drill locations within these new systems.

- Additional exploration activity throughout the Curaçá Valley on other untested high-priority target areas remains ongoing.

- In-Mine and Near Mine Exploration Programs

- Drilling below the Deepening Extension Zone of the Pilar Mine has identified high-grade extensions, including the deepest intercept drilled to date, located approximately 150 meters below the limit of the 2020 inferred mineral resource shell.

- A newly discovered high-grade lens, known as the “Novo Zone”, has been identified approximately 200 meters beneath the main Vermelhos orebodies.

- A near-development, high-grade structure located 15 meters south of existing development within the Toboggan orebody of the Vermelhos Mine was also identified by recent exploration activity.

- Past Producing Mine Re-Evaluation

- Focused on evaluating potential for development of high-grade targets within fully permitted, past producing mines in the Curaçá Valley.

- Drilling underway at Lagoa da Mina, the northern portion of the Angicos Mine (within the Surubim District) and at Suçuarana North (within the Pilar District).

- Additional exploration activities targeting high-grade mineralization beneath the Surubim Mine is expected to commence in Q2 2021.

- Regional Exploration Program

- Corporate Highlights – strong balance sheet supportive of organic growth initiatives

- Conclusion of ongoing studies on the potential optimization of the Boa Esperança Project is expected in early Q3. The 2017 feasibility study outlined a low-capital intensity project producing an average of approximately 21,000 tonnes of payable copper per year over a 7.5-year mine life, resulting in a 32.7% internal rate of return. The Company expects to improve upon this in the 2021 update.

- As previously disclosed, the Company amended its US$75 million senior secured amortizing non-revolving credit facility and US$75 million senior secured revolving credit facility (collectively the “Prior Facilities”) with a US$150 million senior secured revolving credit facility payable in a bullet at maturity, on March 31, 2025 (the “Revolving Credit Facility”). The amendment reduces the Company’s cost of borrowing depending on the Company’s consolidated leverage ratio, and eliminates principal payments previously due in 2022, 2023 and 2024 under the Prior Facilities. Additional detail is provided later in this press release.

- The Company continues to have no material disruption to operations, supply chains or sales channels as a result of the COVID-19 pandemic. The Company has taken extraordinary measures to mitigate the possible impact of COVID-19 on its workforce and operations and to provide critical support to local communities in Brazil ranging from the donation of medical supplies and COVID-19 test kits to food assistance for families impacted by the pandemic.

OPERATING AND FINANCIAL HIGHLIGHTS

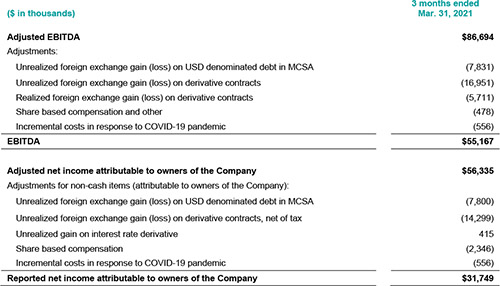

ADJUSTED EBITDA & NET INCOME (LOSS) RECONCILIATION

CREDIT FACILITIES AMENDMENT DETAILS

As previously disclosed, the Company amended its Credit Agreement with The Bank of Nova Scotia (“Scotiabank”) and Bank of Montreal (“BMO”) on March 16, 2021 to amend the Prior Facilities with the Revolving Credit Facility, payable in a bullet at maturity on March 31, 2025. Benefits of the amendment include a reduction of up to 25 basis points in the Company’s cost of borrowing, depending on the Company’s consolidated leverage ratio.

The Revolving Credit Facility will bear interest on a sliding scale at a rate of LIBOR plus 2.25% to 4.25% based on the Company’s consolidated leverage ratio at the time. Commitment fees for any undrawn portion of the Revolving Credit Facility will also be on a sliding scale between 0.56% to 1.06%.

The Revolving Credit Facility includes standard and customary terms and conditions with respect to fees, representations, warranties, and financial covenants that remain unchanged from prior amendments. Scotiabank is Joint Lead Arranger, Sole Bookrunner and Administrative Agent and BMO is Joint Lead Arranger and Syndication Agent.

A copy of the amendment to the Credit Agreement has been filed on SEDAR (www.sedar.com).

2021 PRODUCTION OUTLOOK

The Company is reaffirming its 2021 production guidance. Copper production for 2021 is expected to be equally weighted between the first and second halves of the year with lower Q2 and Q3 copper production due to preventative mill maintenance scheduled during those periods as the Company prepares for expanded operations, including the restart of the Surubim open pit mine in H2 2021. Gold production from NX Gold for 2021 is expected to come from ore mined from the Santo Antonio Vein.

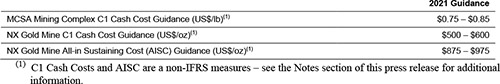

2021 CASH COST GUIDANCE

The Company is reaffirming its 2021 cash cost guidance, which assumes a USD:BRL foreign exchange rate of 5.00, gold price of $1,750 per ounce and silver price of $20.00 per ounce.

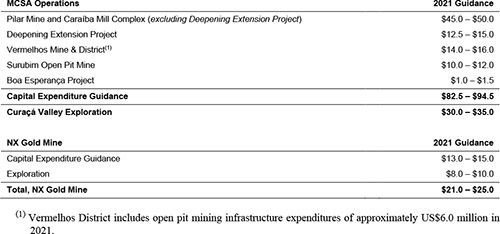

2021 CAPITAL EXPENDITURE GUIDANCE

The Company is reiterating its 2021 capital expenditure guidance, which assumes a USD:BRL foreign exchange rate of 5.00 and has been presented below in USD millions.

CONFERENCE CALL DETAILS

The Company will hold a conference call on Wednesday, May 5, 2021 at 11:30 am Eastern time (8:30 am Pacific time) to discuss these results.

Date: | Wednesday, May 5, 2021 |

Time: | 11:30 am Eastern time (8:30 am Pacific time) |

Dial in: | North America: 1-800-319-4610, International: +1-604-638-5340 |

|

|

Replay | North America: 1-800-319-6413, International: +1-604-638-9010 |

Replay Passcode: | 6549 |

NOTES

Non-IFRS measures

Financial results of the Company are prepared in accordance with IFRS. The Company utilizes certain non-IFRS measures, including C1 cash cost of copper produced (per lb), C1 cash costs of gold produced (per ounce), AISC of gold produced (per ounce), EBITDA, Adjusted EBITDA, Adjusted net income attributable to owners of the Company, Adjusted net income per share, net debt and working capital, which are not measures recognized under IFRS. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

C1 Cash Cost of copper produced (per lb.)

C1 cash cost of copper produced (per lb) is the sum of production costs, net of capital expenditure development costs and by-product credits, divided by the copper pounds produced. C1 cash costs reported by the Company include treatment, refining charges, offsite costs, and certain tax credits relating to sales invoiced to the Company’s Brazilian customer on sales. By-product credits are calculated based on actual precious metal sales (net of treatment costs) during the period divided by the total pounds of copper produced during the period. C1 cash cost of copper produced per pound is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company’s operating mining unit, and is widely reported in the mining industry as benchmarks for performance, but does not have a standardized meaning and is disclosed in addition to IFRS measures.

C1 Cash Cost of gold produced (per ounce)

C1 cash cost of gold produced (per ounce) is the sum of production costs, net of capital expenditure development costs and silver by-product credits, divided by the gold ounces produced. By-product credits are calculated based on actual precious metal sales during the period divided by the total ounces of gold produced during the period. C1 cash cost of gold produced per ounce is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company’s operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

All-in Sustaining Cost of gold produced (per ounce)

All-in sustaining cost of gold produced (per ounce) is the sum of production costs, site general and administrative costs, accretion of mine closure and rehabilitation provision, sustaining capital expenditures, sustaining leases, and royalties and production taxes, net of silver by-product credits, divided by the gold ounces produced. By-product credits are calculated based on actual precious metal sales during the period divided by the total ounces of gold produced during the period. All-in sustaining cost of gold produced per ounce is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company’s operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

Earnings before interest, taxes, depreciation and amortization (EBITDA) and Adjusted EBITDA

EBITDA represents earnings before interest expense, income taxes, depreciation, and amortization. Adjusted EBITDA includes further adjustments for non-recurring items and items not indicative to the future operating performance of the Company. The Company believes EBITDA and adjusted EBITDA are appropriate supplemental measures of debt service capacity and performance of its operations.

Adjusted EBITDA is calculated by removing the following income statement items:

- Foreign exchange loss (gain)

- Share based compensation

- Incremental costs in response to COVID-19 pandemic

Adjusted net income attributable to owners of the Company and Adjusted net income per share attributable to owners of the Company

The Company uses the financial measure “Adjusted net income attributable to owners of the Company” and “Adjusted net income per share attributable to owners of the Company” to supplement information in its consolidated financial statements. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, the Company and certain investors and analysts use this information to evaluate the Company’s performance. The Company excludes non-cash and unusual items from net earnings to provide a measure which allows the Company and investors to evaluate the operating results of the underlying core operations.

During the period, the following non-cash or unusual adjustments to calculated adjusted net income (loss):

- Share based compensation

- Unrealized foreign exchange loss (gain) on USD denominated debt in MCSA

- Unrealized loss (gain) on foreign exchange derivative contracts, net of tax

- Incremental costs in response to COVID-19 pandemic

- Unrealized loss (gain) on interest rate derivative contracts

Net Debt

Net debt is determined based on cash and cash equivalents, restricted cash and loans and borrowings as reported in the Company’s consolidated financial statements. The Company uses net debt as a measure of the Company’s ability to pay down its debt.

Working capital

Working capital is determined based on current assets and current liabilities as reported in the Company’s consolidated financial statements. The Company uses working capital as a measure of the Company’s short-term financial health and operating efficiency.

ABOUT ERO COPPER CORP

Ero Copper Corp, headquartered in Vancouver, B.C., is focused on copper production growth from the MCSA Mining Complex located in Bahia State, Brazil, with over 40 years of operating history in the region. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the MCSA Mining Complex, which is comprised of operations located in the Curaçá Valley, Bahia State, Brazil, wherein the Company currently mines copper ore from the Pilar and Vermelhos underground mines, and the Boa Esperança development project, an IOCG-type copper project located in Pará, Brazil. The Company also owns 97.6% of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the MCSA Mining Complex, Boa Esperança and NX Gold properties, can be found on the Company's website (www.erocopper.com) and on SEDAR (www.sedar.com).

ERO COPPER CORP.

Signed: “David Strang” David Strang, CEO | For further information contact: Courtney Lynn, VP, Corporate Development & Investor Relations (604) 335-7504 |

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information includes statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking information includes, without limitation, statements with respect to the Company’s expectations, strategies and plans for the MCSA Mining Complex, the NX Gold Property and the Boa Esperança Property, including the Company’s planned exploration, development and production activities; the significance and timing of any particular exploration program or result and the Company’s expectations for current and future exploration plans including, but not limited to, planned areas of additional exploration, the significance of any drill results or new discoveries and targets, including without limitation, extensions of defined mineralized zones, possibilities for mine life extensions or continuity of high-grade mineralization, further extensions and expansion of mineralization near the Company’s existing operations and throughout the Curaçá Valley or the NX Gold Mine, statements with respect to the importance of any new discoveries including newly identified mineral systems, the significance of re-evaluation of the Company’s past producing open pit mines, the timing and advancement of ongoing projects including the Deepening Extension Project and the re-start of the Surubim open pit mine; estimated completion dates for certain milestones; the significance of any potential optimization initiatives in connection with the Boa Esperança Property; the impact of the COVID-19 pandemic on the Company’s planned drill programs; the timing and amount of future production at the MCSA Mining Complex and the NX Gold Property; the Company's ability to service its ongoing obligations; the Company's future production outlook, cash costs, capital resources, expenditures, and current global macroeconomic uncertainty stemming from the COVID-19 pandemic and its impact on the Company’s business, financial condition, results of operations, cash flows and prospects.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this Press Release including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the MCSA Mining Complex, NX Gold Mine and the Boa Esperança Property being as described in the technical reports for these properties; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continues to remain healthy in the face of prevailing epidemics, pandemics or other health risks, political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment and critical supplies, spare parts and consumables; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. Such risks include, without limitation the risk factors listed under the heading “Risk Factors” in the AIF.

Although the Company has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking information, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking information contained herein is made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking information, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

Cautionary Notes Regarding Mineral Resource and Reserve Estimates In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with the CIM Standards.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with Measured or Indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an Inferred mineral resource will be upgraded to an Indicated or Measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, Inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.