Vancouver, British Columbia – Ero Copper Corp. (TSX: ERO (the “Company”)) is pleased to provide an update on the ongoing development of the Vermelhos copper mine, part of its 99.5% owned Vale de Curaçá Property located in Bahia State, Brazil, including the assay results of 13 holes drilled as part of the Company’s ongoing infill drilling program at Vermelhos. The results are highlighted by holes FVS-163 that intersected 20.0 meters grading 12.21% copper and FVS-159 that intersected 22.0 meters grading 9.60% copper that rank among the top-five intercepts, on a grade-meter basis, drilled at the mine to date.

MINE DEVELOPMENT UPDATE

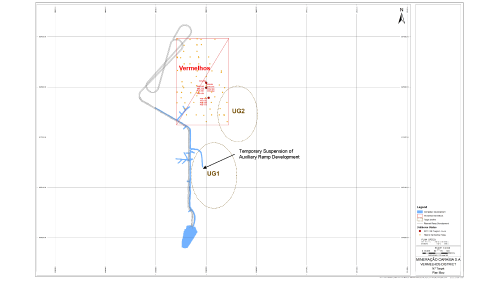

The Company continues to make excellent progress in the development of the Vermelhos mine. Through October 2017, approximately 1,167 meters of underground development has been completed, comprising 635 meters of primary ramp development, 102 meters of auxiliary ramp development accessing the UG1 Target and 430 meters of secondary development. Since primary ramp development commenced at the beginning of May 2017, the average development rate has been approximately 105 meters per month, well ahead of the development rate envisioned in the NI 43-101 Technical Report of 75 meters per month.

The auxiliary ramp development accessing the UG1 Target has been temporarily suspended as a result of the development encountering unexpected massive sulphide copper mineralization. A drill rig (one of the 3 currently focused on the infill program) is being moved to the area to further evaluate the extent and direction of the newly encountered mineralization prior to restarting development. The Company does not believe that the temporary delay in the auxiliary ramp development will impact the production start up, currently scheduled for the fourth quarter of 2018.

The construction of Phase 1 surface infrastructure is now 100% complete and Phase 2 is progressing on schedule. Long-lead time equipment orders required for first production have been placed with the respective vendors and deliveries are expected to begin in the second quarter of 2018. The construction of the 28 kilometer power line to provide electricity to the mine is now complete and is being tied into the mine’s electrical infrastructure. The haul road to deliver ore from Vermelhos to the Caraíba Mill is expected to begin construction in the first quarter of 2018.

2017 INFILL DRILL PROGRAM RESULTS

The infill drill program, comprising 3 core drill rigs, is focused on completing the required drilling for final, detailed mine planning purposes. The results of the program, to date, continue to demonstrate the high-grade nature of the Vermelhos Mineral Resource. In total, the 2017 infill program is expected to encompass 30 holes totalling approximately 7,500 meters of drilling. The results of 13 holes drilled to date from 3 drill collar locations are shown in the table below (see attached map for drill collar locations):

| Hole ID | From (m) | To (m) | Length (m) | Cu (%) |

|---|---|---|---|---|

FVS-143 | 135.9 | 141.1 | 5.2 | 5.79 |

and | 169.4 | 175.9 | 6.5 | 1.52 |

and | 200.0 | 203.5 | 3.5 | 3.00 |

FVS-146 | NSI | NSI | NSI | NSI |

FVS-150 | 144.5 | 156.0 | 11.5 | 2.86 |

FVS-154 | 135.7 | 146.4 | 10.6 | 9.16 |

FVS-156 | 174.3 | 181.7 | 7.4 | 3.50 |

FVS-159 | 132.4 | 154.4 | 22.0 | 9.60 |

and | 182.1 | 192.8 | 10.7 | 2.52 |

including | 188.7 | 192.8 | 4.1 | 3.76 |

FVS-160 | 169.5 | 181.4 | 11.9 | 4.52 |

and | 191.7 | 199.9 | 8.1 | 2.76 |

FVS-161 | 145.3 | 149.7 | 4.4 | 16.75 |

FVS-162 | 147.0 | 159.2 | 12.2 | 11.73 |

FVS-163 | 142.1 | 162.1 | 20.0 | 12.21 |

FVS-164 | 176.5 | 183.3 | 6.8 | 6.41 |

and | 193.0 | 199.7 | 6.8 | 4.86 |

FVS-169 | 108.1 | 117.6 | 9.4 | 4.77 |

FVS-173 | NSI | NSI | NSI | NSI |

The drill holes were drilled from surface. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter. NSI: no significant intercept. Listed holes include infill program with available assay results. Holes not included are either pending assay results or are not part of the Vermelhos infill program.

Currently 4 drill rigs are operating at Vermelhos. As discussed above, 3 core drill rigs are focused on completing the infill drilling program, and a reverse circulation (RC) rig is targeting near-surface copper oxide mineralization. Once the infill program has been completed, drilling will focus on further delineating mineralization previously identified at the UG1 and UG2 target areas (see attached map) along with newly identified target areas to the west and north of the current NI 43-101 Mineral Resources.

The Vermelhos copper mine, is located approximately 80 kilometers north of the Pilar underground mine and Caraíba Mill. The current NI 43-101 compliant Proven and Probable Mineral Reserve estimate for Vermelhos is 2.4 million tonnes grading 4.15% copper, while the current NI 43-101 compliant Mineral Resource estimate, inclusive of Mineral Reserves, contains Measured and Indicated Mineral Resources of 2.5 million tonnes grading 4.78% copper and an Inferred Mineral Resource of 2.2 million tonnes grading 1.52% copper. Additional technical information related to the Mineral Reserve and Mineral Resource estimates can be found in the Vale do Curaçá Technical Report, dated September 7, 2017.

ABOUT ERO COPPER CORP

Ero Copper Corp, headquartered in Vancouver, B.C., is focused on copper production growth from the Vale do Curaçá Property, located in Bahia, Brazil. The Company’s primary asset is a 99.5% interest in the Brazilian copper mining company, Mineração Caraíba S.A. (“MCSA”), 100% owner of the Vale do Curaçá Property with over 37 years of operating history in the region. The Company currently mines copper ore from the Pilar underground and the Surubim open pit mines. In addition to the Vale do Curaçá Property, MCSA owns 100% of the Boa Esperanҫa development project, an IOCG-type copper project located in Pará, Brazil. Additional information on the Company and its operations, including Technical Reports on both the Vale do Curaçá and Boa Esperanҫa properties, can be found on the Company’s website (www.erocopper.com) and on SEDAR ( www.sedar.com).

Rubens Mendonça, MAusIMM, has reviewed and approved the scientific and technical information contained in this news release. Mr. Mendonça is a Qualified Person and is independent of Ero Copper Corp. as defined by NI 43-101.

ERO COPPER CORP.

Signed: “David Strang”

David Strang, President & CEO

For further information contact:

Makko DeFilippo, Vice President, Corporate Development

(604) 429-9244

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS This news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements include, but are not limited to, statements with respect to the anticipated development timeline of the Vermelhos mine and the existence of near-surface oxide material in sufficient quantities and grade from which to define an oxide Mineral Resource.

Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this news release including, without limitation, assumptions about: development and exploration of the Company’s properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any Mineral Reserve and Mineral Resource estimates; the geology of the Vale do Curaçá Property as described in the Vale do Curaçá Technical Report; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to general economic conditions, political conditions in Canada and Brazil, risks related to international operations, the actual results of current mining and exploration activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, future prices of copper, gold and silver, market conditions and the availability of financing for mining companies. There can be no assurance that any forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are included herein, except in accordance with applicable securities laws.

GENERAL Information of a scientific or technical nature in respect of the Vale do Curaçá Property included in this news release is based upon the Vale do Curaçá Technical Report, dated September 7, 2017 with an effective date of June 1, 2017, prepared by Rubens Mendonça, MAusIMM, of SRK Brazil, and Porfirio Cabaleiro Rodrigues, MAIG, Mário Conrado Reinhardt, MAIG, Fábio Valério Xavier, MAIG and Bernardo H.C. Viana, MAIG, all of GE21, who are independent qualified persons under NI 43-101.

Please see the Vale do Curaçá Technical Report filed on the Company’s profile at www.sedar.com, for details regarding the data verification undertaken with respect to the scientific and technical information included in this news release regarding the Vale do Curaçá Property for additional details regarding the related exploration information, including interpretations, the QA/QC employed, sample, analytical and testing results and for additional details regarding the Mineral Resource and Mineral Reserve estimates discussed herein.