(all amounts in US dollars, unless otherwise noted)

Vancouver, British Columbia – Ero Copper Corp. (TSX: ERO, NYSE: ERO) (“Ero” or the “Company”) is pleased to announce the results of its optimized Feasibility Study (the "2021 Feasibility Study") on the Boa Esperança Copper Project ("Boa" or the "Project"), located in Pará State, Brazil.

HIGHLIGHTS

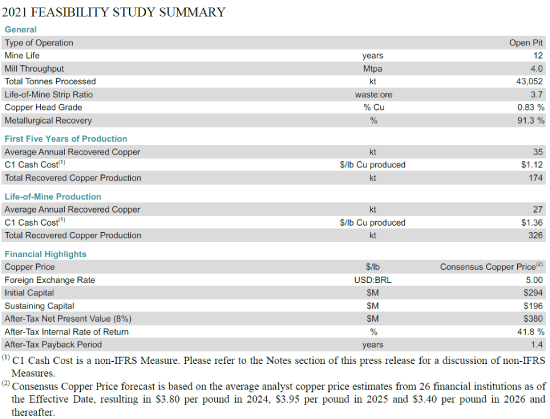

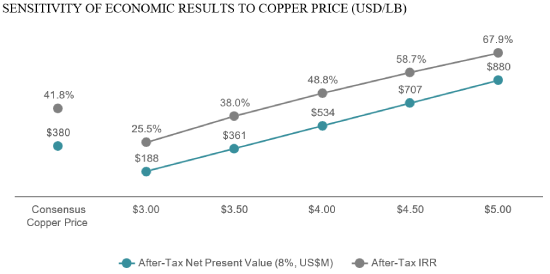

- 41.8% after-tax internal rate of return ("IRR") and $380 million after-tax net present value (8%) based on Consensus Copper Price (as defined below) and 5.00 BRL:USD exchange rate;

- Doubled life-of-mine ("LOM") copper production to approximately 326,000 tonnes from 163,000 tonnes in the 2017 Study (as defined below) with increased mine life of twelve years;

- Increased annual average LOM copper production from approximately 18,000 tonnes to over 27,000 tonnes, with the first five years of production averaging approximately 35,000 tonnes per annum;

- Mine life of twelve years supported by updated proven mineral reserves of 30.7 million tonnes at 0.89% copper and probable mineral reserves of 12.4 million tonnes at 0.67% copper, containing a total of 356.6 thousand tonnes of copper, a 93% increase in contained copper as compared to the 2017 Study (as defined below);

- Low capital-intensity of approximately $8,400 per tonne of copper produced annually over the first 5 years of the Project resulting in rapid payback of 1.4 years at Consensus Copper Price;

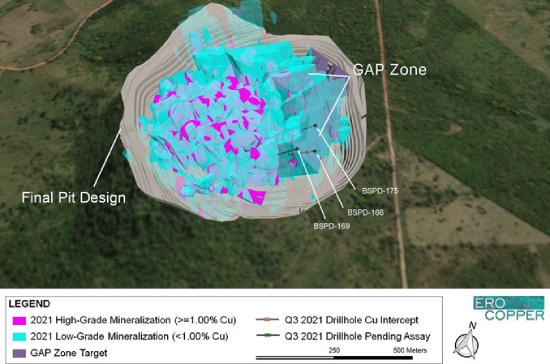

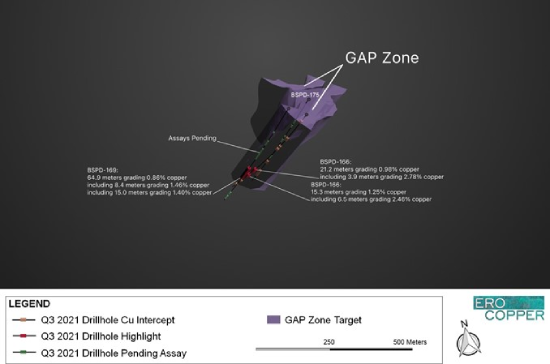

- Significant exploration upside identified within an under-explored area within the final pit limits, known as the "Gap Zone", expected to enhance the Project by (i) confirming continuity of mineralization between near-surface high-grade zones and high-grade zones near the pit limits at depth; and, (ii) converting material currently classified as waste into mineral resources. Subsequent to August 31, 2021, or the effective date of the mineral resource and mineral reserve estimates in the 2021 Feasibility Study (the “Effective Date”), ten exploration holes were drilled in the Gap Zone, all of which showed mineralization. To date, assay results have been received for three of these holes. Results are highlighted by hole BSPD-166 that intercepted 21.2 meters grading 0.98% copper and 15.3 meters grading 1.25% copper and BSPD-169 that intercepted 64.9 meters grade 0.86% copper including 15.0 meters grading 1.40% copper; and

- Detailed engineering design efforts are currently underway with early construction works expected to commence during H1 2022, subject to the approval of Ero's Board of Directors.

2021 FEASIBILITY STUDY SUMMARY

SENSITIVITY OF ECONOMIC RESULTS TO COPPER PRICE (USD/LB)

Commenting on the results, David Strang, CEO, stated, “The Boa Esperança Project is the most recent example of our team's commitment and outstanding track record of creating shareholder value from our existing portfolio, and we could not be more excited about the outcome of these efforts. We started the re-evaluation of Boa from the ground up, beginning with a complete review of the mineral resource calculations that identified significant upside opportunities on which to build a new vision for Boa.

“By re-logging core, focusing our efforts on geologic modelling and optimizing the mine sequence, we were able to identify a superior mine plan capable of supporting a much larger operation by pulling forward high-grade mineralization in the production plan. The result of this work is significantly higher annual copper production averaging approximately 35,000 over the first five years of the mine's life, a very attractive payback of 1.4 years and a 41.8% internal rate of return. Further, we see potential for additional value generation through ongoing exploration within the newly designed final pit shell.

“Our near-term focus will be targeting exploration in an area referred to as the Gap Zone, where we currently have four drill rigs operating. The Gap Zone is a sizeable target area within the current pit shell where there has been limited historic drilling. As a result, material mined from this zone, which is currently included in the later phases of the mine plan, is largely treated as waste. While early in the program, the ten holes we have drilled within the Gap Zone subsequent to the cut-off date of the 2021 Feasibility Study show mineralized zones in the areas where we would expect to see extensions and continuity of mineralization. With continued exploration success, we see potential to meaningfully increase the mine's production profile beyond year five of the current life-of-mine plan.

"Our excitement around our organic growth initiatives, including the delivery of the Boa Esperança Project and production growth at the MCSA Mining Complex, continues to build as we establish a clear path to doubling our copper production profile over the coming years while continuing to generate peer- leading returns on invested capital. With a robust balance sheet and strong cash flow generation, we are well-positioned to execute on our growth strategy and continue delivering shareholder value."

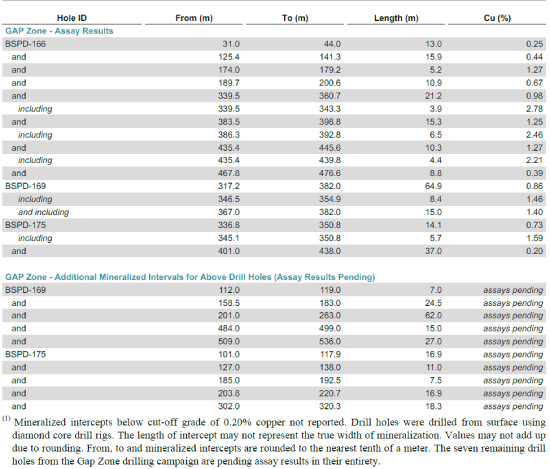

GAP ZONE EXPLORATION SUCCESS

Subsequent to the Effective Date, ten exploration drill holes were drilled within the Gap Zone, all of which show mineralization. To date, assay results have been received for three of these holes. Results are highlighted by hole BSPD-166 that intercepted 21.2 meters grading 0.98% copper and 15.3 meters grading 1.25% copper, including 6.5 meters grading 2.46% copper, hole BSPD-169 that intercepted 64.9 meters grade 0.86% copper, including 15.0 meters grading 1.40% copper and hole BSPD-175 that intercepted 14.1 meters grading 0.73% copper including 5.7 meters grading 1.59% copper. Additional mineralized intercepts from within these holes are pending assay results.

Continued positive exploration results within the Gap Zone are expected to further enhance the Project by (i) confirming continuity of mineralization between near-surface high-grade zones and high-grade zones near the pit limits at depth; and, (ii) converting material currently classified and mined as waste into mineral resources. The Company expects the Gap Zone to contribute to increased copper production beyond year five of the mine plan.

Gap Zone drill results outlined in this press release, including drill collar locations, are shown below in Figure 1 and can be viewed on the Company’s Boa Esperança project tour and interactive three- dimensional ("3D") model, which can be accessed via the Company’s VRIFY Technology Inc. (“VRIFY”) project page (http://www.vrify.com/companies/ero-copper-corp) or via VRIFY directly (www.vrify.com).

Gap Zone drill results from BSPD-166, BSPD-169 and BSPD-175, as referenced herein, reflects mineralization not captured in the Company's NI 43-101 (as defined below) compliant mineral resource and mineral reserve models developed for the 2021 Feasibility Study. There has been insufficient work and analysis surrounding Gap Zone drilling to define a mineral resource and it is uncertain if further exploration and analysis will result in such targets being delineated as a mineral resource.

Figure 1 shows high-grade and low-grade mineralization, as well as the Gap Zone exploration target area within the final pit design of the Project. Figure 2 highlights recent Gap Zone drilling results.

The center of the final pit design is located at UTM Easting 450722.00 and UTM Northing 9241657.00. Boa Esperança mineralization based on data compilation work which includes review of geological controls, structural analysis and copper mineralization identified during the Company’s technical programs. The interpretation and boundary limits do not imply continuity of mineralization or actual thickness of mineralization. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Figure 1: Boa Esperança VRIFY 3D Model, Plan View looking North (Ero Copper, 2021)

The center of the final pit design is located at UTM Easting 450722.00 and UTM Northing 9241657.00. The GAP Zone volume is shown to demonstrate a future area of exploration within the Boa Esperança final pit design. The shape is based on data compilation work which includes review of geological controls and structural analysis during the Company’s technical programs. The interpretation and boundary limits do not imply continuity of mineralization or actual thickness of mineralization.

Figure 2: Boa Esperança VRIFY 3D Model, Gap Zone Results, view looking North (Ero Copper, 2021)

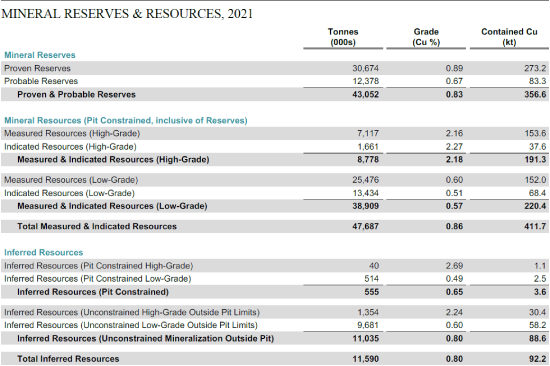

MINERAL RESERVES & RESOURCES, 2021

(1) Mineral reserves and mineral resources have an effective date of August 31, 2021.

(2) Stated mineral resources are inclusive of mineral reserves. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to rounding. High-grade and low-grade mineral resources defined as greater than or equal to 1.00% copper and less than 1.00% copper, respectively.

(3) A 3D geologic model was developed for the Boa Esperança Project. Geologically constrained copper grade shells were developed using a copper cut-off grade of 0.20% and 0.51% for pit constrained and unconstrained mineral resources, respectively, to generate a 3D mineralization model of the Boa Esperança Project. Within grade shells, mineral resources were estimated using ordinary kriging within a 2.0 meter by 2.0 meter by 4.0 meter block size. Open pit constrained, unconstrained and marginal cut-off grades are based upon a copper price of US$6,400 per tonne with cost parameters appropriate to the deposit. The mineral resource estimates were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “CIM Standards”), and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019 (the ‘CIM Guidelines”), using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

(4) Mineral reserve estimates were prepared in accordance with the CIM Standards and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate for the deposit. Mineral reserves are based on a long-term copper price of US$6,613 per tonne; concentrate grade of 27% copper; average metallurgical recoveries of 91.3%; copper concentrate logistics costs of US$108.20 per wet metric tonne ("wmt"); transport losses of 0.2%; copper concentrate treatment charges of US$59.50 per dry metric tonne ("dmt"), refining charges of U$0.0595 per pound of copper; copper payability of 96.3%; average mining cost of US$2.47 per tonne mined; processing cost of US$7.74 per tonne processed and G&A costs of US$3.83 per tonne processed; average pit slope angles that range from 30º for saprolite to 50º for fresh rock and a 2% CFEM government royalty.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Please refer to the Technical and Scientific section of this press release for additional information.

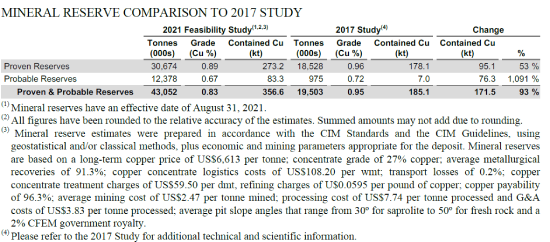

MINERAL RESERVE COMPARISON TO 2017 STUDY

Please refer to the Technical and Scientific section of this press release for additional information.

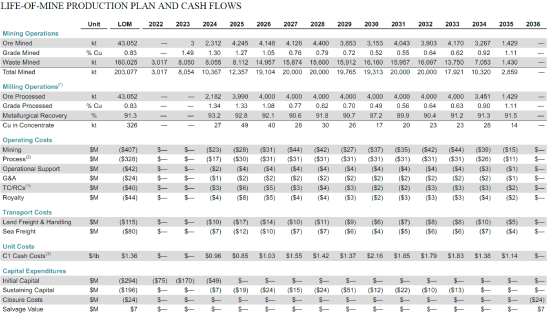

LIFE-OF-MINE PRODUCTION PLAN AND CASH FLOWS

(*) Milling Operations reflect timing adjustments related to run-of-mine stockpile handling. Summed amounts may not add due to rounding.

(1) TC/RCs defined as treatment charges and refining charges.

(2) Process includes mill operating and maintenance expenses as well as costs related to dry stack tailings.

(3) C1 Cash Cost is a non-IFRS Measure. Please refer to the Notes section of this press release for a detailed definition.

TECHNICAL AND SCIENTIFIC INFORMATION

Permitting

The Economic Exploitation Plan (PAE) for the Project was ratified in 2012 and subsequently renewed in 2013. The Company received the Installation License (LI) in August 2021, which will allow for the commencement of surface and civil construction activities in H1 2022. A formal request with the Secretaria de Estado de Meio Ambiente e Sustentabilidade ("SEMAS") will be made to incorporate changes in the Project's scope as outlined in the 2021 Feasibility Study. SEMAS is the agency responsible for approval of the Operating License (LO) for the Project, which is planned to be issued at the time of commercial production.

Mineral Resources

Block model tonnage and grade estimates for the Project were classified according to the CIM Standards and the CIM Guidelines by Mr. Emerson Ricardo Re, RM CMC (0138) and MAusIMM (CP) (305892), an employee of Ero Copper Corp. and a qualified person as such term is defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101").

A 3D geologic model was developed for the Project. Geologically constrained grade shells were developed using various copper cut-off grades to generate a 3D mineralization model of the Project. Within the grade shells, mineral resources were estimated using ordinary kriging within a 2.0 meter by 2.0 meter by 4.0 meter block size. Within the optimized resource open pit limits, a cut-off grade of 0.20% copper was applied based upon a copper price of US$6,400 per tonne, net smelter return ("NSR") of 94.53%, average metallurgical recoveries of 90.7%, mining recovery of 95.0%, dilution of 5.0%, mining costs of US$3.10 per tonne mined run of mine ("ROM"), processing and transportation costs of US$5.65 per tonne ROM, and G&A costs of US$2.66 per tonne ROM. Unconstrained inferred mineral resources have been stated at a cut-off grade of 0.51% copper with a marginal cut-off grade of 0.32% copper based upon a copper price of US$6,400 per tonne, NSR of 94.53%, mining recovery of 100%, average metallurgical recoveries of 90.7%, mining costs of US$14.71 per tonne ROM, processing and transportation costs of US$5.70 per tonne ROM, and G&A costs of US$2.60 per tonne ROM. Stated mineral resources estimates are inclusive of mineral reserves.

The mineral resource effective date is August 31, 2021.

Mineral Reserves

The mineral reserves for the Project are derived from the Measured and Indicated mineral resources as defined within the resource block model following the application of economic and other modifying factors further described below. Inferred mineral resources, where unavoidably mined within a defined mining shape have been assigned zero grade. Dilution occurring from Indicated resource blocks were assigned grade based upon the current mineral resource grade of the blocks included in the dilution envelope. Mineral reserves were classified according to the CIM Standards and the CIM Guidelines by Mr. Carlos Guzman, RM CMC (0119) and FAusIMM (229036), an employee of NCL Ingenieria y Construcion SpA ("NCL") and an independent qualified person as such term is defined under NI 43-101. NCL is independent of the Company.

The pit designs and mine plan were optimized using the following economic and technical parameters: copper price of US$6,613 per tonne; average metallurgical recoveries of 91.3%; concentrate grade of 27% copper, copper concentrate logistics costs of US$108.20 per wmt; transport losses of 0.20%; copper concentrate treatment charges of US$59.50 per dmt, refining charges of U$0.0595 per pound of copper; copper payability of 96.3%; average mining cost of US$2.47 per tonne mined; processing costs of US$7.74 per tonne processed and G&A costs of US$3.83 per tonne processed; average pit slope angles that range from 30º for saproloite to 50º for fresh rock and a 2% CFEM government royalty.

Other modifying factors considered in the determination of the mineral reserve estimate include:

- Overall slope angles of 30.0 degrees for saprolite, 42.0 degrees for weathered rock and 50.0 degrees for fresh rock;

- Maximum bench height of 8.0 meters for saprolite and weathered rock and 16.0 meter double- benches for fresh rock;

- Double-traffic ramp design of 18.0 meters in width with 10% maximum gradient; and

- Mining shapes of 6.0 meters by 10.0 meters with 4.0 meter flitch mining with consideration for orebody orientation.

The mineral reserve effective date is August 31, 2021.

NOTES

Non-IFRS measures

The Company uses certain non-IFRS measures, including C1 cash cost of copper produced (per lb) and EBITDA, which are not measures recognized under IFRS. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

C1 cash cost of copper produced (per lb.)

- C1 cash cost of copper produced (per lb) is the sum of production costs, net of capital expenditure development costs, divided by the copper pounds produced. C1 cash cost reported by the Company include treatment, refining charges, and offsite costs. C1 cash cost of copper produced per pound is a non-IFRS measure used by the Company to manage and evaluate operating performance of the Company’s operating mining unit and is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in addition to IFRS measures.

Earnings before interest, taxes, depreciation and amortization (EBITDA)

- EBITDA represents earnings before interest expense, income taxes, depreciation, and amortization. The Company believes EBITDA is an appropriate supplemental measure of debt service capacity and performance of its operations.

DATA VERIFICATION & QUALITY ASSURANCE / QUALITY CONTROL

The qualified persons responsible for the preparation of the 2021 Feasibility Study have verified the data disclosed, including sampling, analytical, and test data underlying the information contained in this news release. Geological, mine engineering and metallurgical reviews included, among other things, reviewing mapping, core logs, and re-logging existing drill holes, review of geotechnical and hydrological studies, environmental and community factors, the development of the life of mine plan, capital and operating costs, transportation, taxation and royalties, and review of existing metallurgical test work. In the opinion of the qualified persons responsible for the preparation of the 2021 Feasibility Study, the data, assumptions, and parameters used to estimate mineral resources and mineral reserves, the metallurgical model, and the economic analysis as presented herein are sufficiently reliable for these purposes.

The Company is currently drilling at the Project from surface with core drill rigs operated by a third- party contractor. Third-party drill rigs are operated by DrillGeo Geologia e Sondagem Ltda., who is independent of the Company. Drill core is logged, photographed, and split in half using a diamond saw and then quartered. One half is sent for analysis and the remaining half is sent for storage at the secure core logging and storage facilities for the Project located in the city of Tucumã, Para State, Brazil. Samples are collected on one-and-a-half-meter sample intervals unless an interval crosses a geological contact. At the completion of sample batching, individual sample bags are placed into plastic bags which are numbered and labelled with the respective sample interval and batch identification. Sample batches are transported to a third-party laboratory for preparation and analyses, along with a sample submission form.

Total copper and gold analysis is performed at ALS Brasil Ltda’s ("ALS") facilities in Parauapebas, Brazil (physical) and Lima, Peru (analytical). Total copper is determined using a hydrofluoric, nitric, perchloric acid digestion and HCl leach and analyzed using Inductively Coupled Plasma - Mass Spectrometry (“ICP-MS”) and Atomic Absorption Spectrometry (“AAS”). Gold values are determined using lead collection fire assay and Inductively Coupled Plasma – Optical Emission Spectrometry ("ICP-OES"). ALS is a subsidiary of ALS Limited and is independent of the Company. All sample results during the period have been monitored through a quality assurance, quality control program that includes the insertion of certified standards, blanks, and field duplicate samples.

Qualified Persons and the NI 43-101 Technical Report

Mr. Emerson Ricardo Re, RM CMC (0138) and MAusIMM (CP) (305892), an employee of Ero Copper Corp. and a qualified person as such term is defined under NI 43-101, has reviewed and approved the scientific and technical information contained in this press release related to Gap Zone exploration drill results.

Mr. Kevin Murray, P.Eng registered with Engineers and Geoscientists British Columbia, License #32350, and an employee of Ausenco, an independent qualified person as such term is defined under NI 43-101 has reviewed and approved all other technical and scientific information in this press release. Ausenco is independent of the Company.

The Company will file the associated NI 43-101 compliant report on SEDAR (www.sedar.com) and on the Company’s website (www.erocopper.com) within 45 days of this press release, which will serve as an update to the technical report entitled “Feasibility Study Technical Report for the Boa Esperança Copper Project, Pará State, Brazil”, dated September 7, 2017 with an effective date of June 1, 2017, prepared by Rubens Mendonça, MAusIMM of SRK Consultores do Brasil Ltda. (“SRK”) as at the date of the report and Carlos Barbosa, MAIG and Girogio di Tomi, MAusIMM, both of SRK Brazil, and each a “qualified person” and “independent” of the Company within the meanings of NI 43-101 (the “2017 Study”).

ABOUT ERO COPPER CORP

Ero Copper Corp., headquartered in Vancouver, B.C., is focused on copper production growth from the Mineração Caraíba S.A. ("MCSA") Mining Complex located in Bahia State, Brazil, with over 40 years of operating history in the region. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the MCSA Mining Complex, which is comprised of operations located in the Curaçá Valley, Bahia State, Brazil, wherein the Company currently mines copper ore from the Pilar and Vermelhos underground mines, and the Boa Esperança Project, an IOCG- type copper development project located in Pará, Brazil. The Company also owns 97.6% of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the MCSA Mining Complex, Boa Esperança and NX Gold properties, can be found on the Company's website (www.erocopper.com), on SEDAR (www.sedar.com), and on EDGAR (www.sec.gov).

ERO COPPER CORP.

/s/ David Strang

David Strang, CEO

For further information contact: Courtney Lynn, VP, Corporate Development & Investor Relations

(604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking statements include, without limitation, statements with respect to mineral reserve and mineral resource estimates as well as life-of-mine plans; targeting additional mineralization within the Boa Esperança property, including within the Gap Zone; the Company’s planned exploration, development and production activities with respect to the Boa Esperança Project; the significance of any drill results including, but not limited to, extensions of defined mineralized zones, possibilities for mine life extensions or continuity of high-grade mineralization, the ability to convert material currently classified as waste within the Boa Esperança mine plan to mineralized material, the potential to increase or augment production over Boa Esperança's mine life, the recoverable value of any metals other than copper; the estimated timing of certain milestones including the commencement of early works and construction of Boa Esperança Project; the planned timing for receipt of the Project's Operating License (LO), the significance of any potential optimization initiatives in connection with the Boa Esperança Project; the Company's future production outlook, cash costs, capital resources and expenditures; the Company's ability to internally fund future growth initiatives; and the Company's ability to further improve Boa Esperança Project's economics including internal rate of return and net present value.

Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this press release including, without limitation, assumptions about: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the MCSA Mining Complex, NX Gold Property and the Boa Esperança Property being as described in the technical reports for these properties; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force conditions to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment and critical supplies, spare parts and consumables; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive, global health, and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking statements involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation the risk factors listed under the heading “Risk Factors” in the Annual Information Form dated March 12, 2021.

Although the Company has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained herein. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with the CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in NI 43-101. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with measured or indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.